Summary

Open Banking powered machine learning applications require novel robustness approaches to deal with challenging stress and failure scenarios. In this paper we propose an hierarchical fallback architecture for improving robustness in high risk machine learning applications with a focus in the financial domain. We define generic failure scenarios often found in online inference that depend on external data providers and we describe in detail how to apply the hierarchical fallback architecture to address them. Finally, we offer a real world example of its applicability in the industry for near-real time transactional fraud risk evaluation using Open Banking data and under extreme stress scenarios.

AI Key Findings

Generated Jun 13, 2025

Methodology

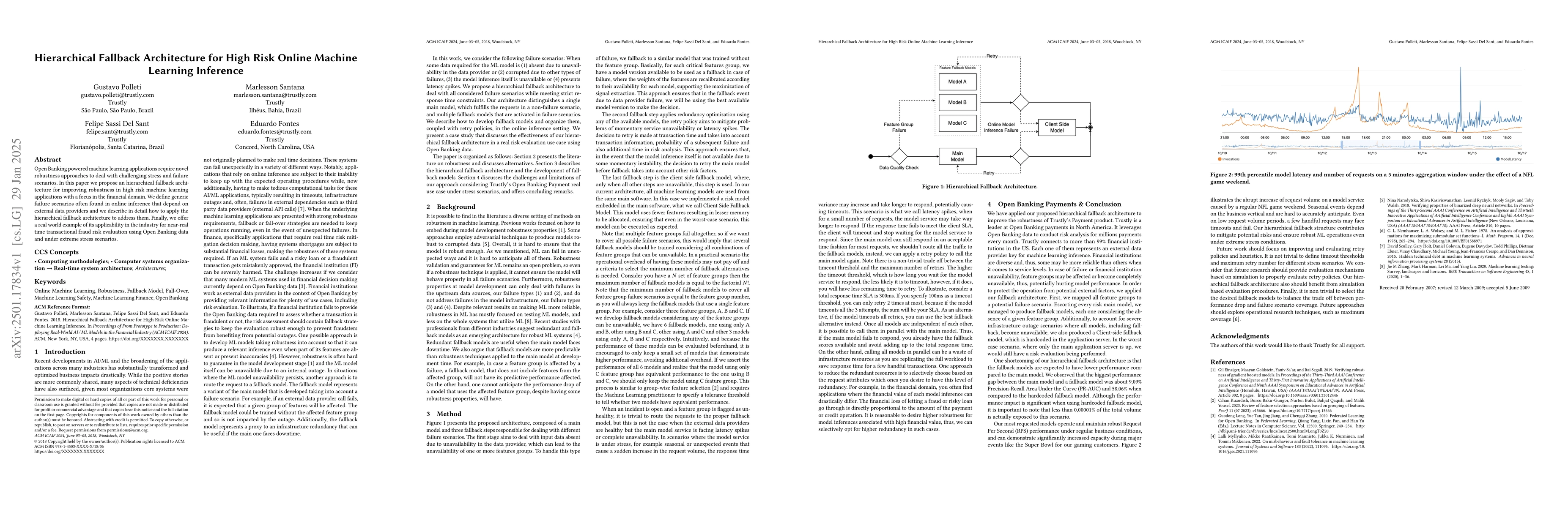

The paper proposes a hierarchical fallback architecture for high-risk online machine learning applications, focusing on the financial domain. It addresses failure scenarios like absent, corrupted data, unavailable model inference, and latency spikes by employing a main model and multiple fallback models, each addressing specific failure types.

Key Results

- The architecture effectively handles various failure scenarios while adhering to strict response time constraints.

- A case study demonstrates the effectiveness of the hierarchical fallback architecture in a real-world risk evaluation use case using Open Banking data.

- The approach ensures robustness in financial applications that rely on Open Banking data for real-time risk mitigation decisions.

Significance

This research is important as it tackles the challenge of ensuring robustness in AI/ML systems, particularly in high-risk financial applications that rely on external data providers, which can fail unexpectedly.

Technical Contribution

The paper presents a hierarchical fallback architecture that combines a main model with multiple fallback models, each addressing specific failure scenarios, ensuring robustness in high-risk online machine learning applications.

Novelty

The proposed hierarchical fallback architecture distinguishes itself by addressing various failure scenarios in a structured manner, catering to the unique challenges of high-risk, real-time financial decision-making applications that depend on external data providers.

Limitations

- Fallback models generally have lower performance compared to the main model.

- Determining optimal timeout thresholds and maximum retry numbers for different stress scenarios is non-trivial.

Future Work

- Future work should focus on improving and evaluating retry policies and heuristics.

- Simulation-based evaluation mechanisms should be developed to properly assess retry policies.

- Future approaches should explore operational research techniques to balance the trade-off between performance drop and failure scenario coverage.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn FPGA Architecture for Online Learning using the Tsetlin Machine

Ole-Christoffer Granmo, Alex Yakovlev, Rishad Shafik et al.

Online Algorithms for Hierarchical Inference in Deep Learning applications at the Edge

Jaya Prakash Champati, Vishnu Narayanan Moothedath, James Gross

Multi-Resolution Online Deterministic Annealing: A Hierarchical and Progressive Learning Architecture

Christos Mavridis, John Baras

No citations found for this paper.

Comments (0)