Authors

Summary

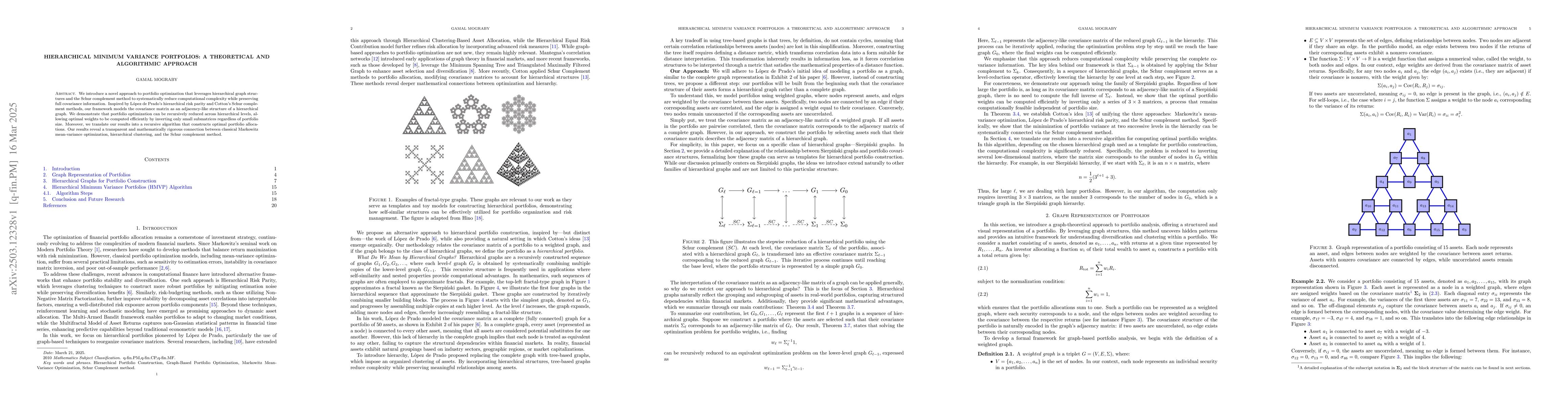

We introduce a novel approach to portfolio optimization that leverages hierarchical graph structures and the Schur complement method to systematically reduce computational complexity while preserving full covariance information. Inspired by Lopez de Prados hierarchical risk parity and Cottons Schur complement methods, our framework models the covariance matrix as an adjacency-like structure of a hierarchical graph. We demonstrate that portfolio optimization can be recursively reduced across hierarchical levels, allowing optimal weights to be computed efficiently by inverting only small submatrices regardless of portfolio size. Moreover, we translate our results into a recursive algorithm that constructs optimal portfolio allocations. Our results reveal a transparent and mathematically rigorous connection between classical Markowitz mean-variance optimization, hierarchical clustering, and the Schur complement method.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces a novel portfolio optimization approach using hierarchical graph structures and the Schur complement method to efficiently reduce computational complexity while maintaining full covariance information.

Key Results

- Hierarchical portfolio optimization allows recursive reduction across levels, enabling efficient computation of optimal weights by inverting small submatrices regardless of portfolio size.

- The framework connects classical Markowitz mean-variance optimization, hierarchical clustering, and the Schur complement method in a transparent and mathematically rigorous manner.

- A recursive algorithm is developed to construct optimal portfolio allocations based on the hierarchical graph structure.

Significance

This research is important as it provides an efficient method for portfolio optimization, which can handle large-scale problems and preserve full covariance information, potentially benefiting financial institutions and investors.

Technical Contribution

The main technical contribution is the development of a hierarchical graph-based portfolio optimization framework that leverages the Schur complement method to efficiently compute optimal portfolio weights.

Novelty

This work stands out by combining hierarchical risk parity, hierarchical clustering, and the Schur complement method, offering a novel and mathematically rigorous approach to portfolio optimization.

Limitations

- The paper does not provide empirical evidence of the proposed method's performance compared to existing techniques.

- The approach assumes that the covariance matrix can be accurately modeled as a hierarchical graph structure.

Future Work

- Further research could validate the proposed method using real-world datasets and compare its performance against existing portfolio optimization techniques.

- Investigating the applicability of this method to dynamic and time-varying covariance structures could be an interesting direction.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReactive Global Minimum Variance Portfolios with $k-$BAHC covariance cleaning

Damien Challet, Christian Bongiorno

Advancing Portfolio Optimization: Adaptive Minimum-Variance Portfolios and Minimum Risk Rate Frameworks

Svetlozar T. Rachev, Frank J. Fabozzi, Abootaleb Shirvani et al.

No citations found for this paper.

Comments (0)