Authors

Summary

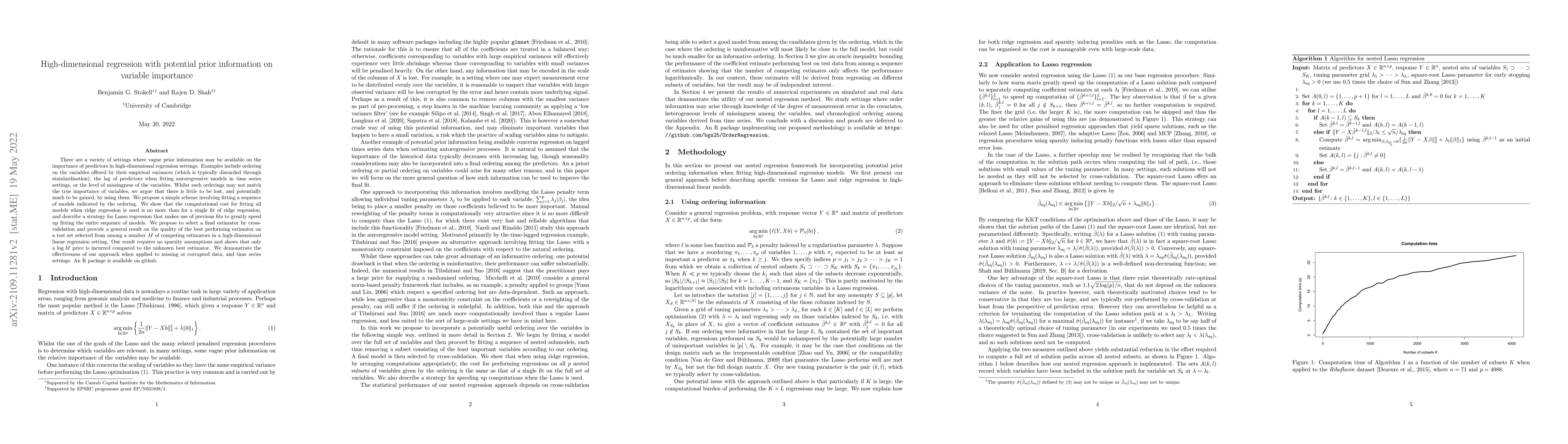

There are a variety of settings where vague prior information may be available on the importance of predictors in high-dimensional regression settings. Examples include ordering on the variables offered by their empirical variances (which is typically discarded through standardisation), the lag of predictors when fitting autoregressive models in time series settings, or the level of missingness of the variables. Whilst such orderings may not match the true importance of variables, we argue that there is little to be lost, and potentially much to be gained, by using them. We propose a simple scheme involving fitting a sequence of models indicated by the ordering. We show that the computational cost for fitting all models when ridge regression is used is no more than for a single fit of ridge regression, and describe a strategy for Lasso regression that makes use of previous fits to greatly speed up fitting the entire sequence of models. We propose to select a final estimator by cross-validation and provide a general result on the quality of the best performing estimator on a test set selected from among a number $M$ of competing estimators in a high-dimensional linear regression setting. Our result requires no sparsity assumptions and shows that only a $\log M$ price is incurred compared to the unknown best estimator. We demonstrate the effectiveness of our approach when applied to missing or corrupted data, and time series settings. An R package is available on github.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConsistent Bayesian Information Criterion Based on a Mixture Prior for Possibly High-Dimensional Multivariate Linear Regression Models

Haruki Kono, Tatsuya Kubokawa

No citations found for this paper.

Comments (0)