Authors

Summary

Although multivariate stochastic volatility models usually produce more accurate forecasts compared to the MGARCH models, their estimation techniques such as Bayesian MCMC typically suffer from the curse of dimensionality. We propose a fast and efficient estimation approach for MSV based on a penalized OLS framework. Specifying the MSV model as a multivariate state space model, we carry out a two-step penalized procedure. We provide the asymptotic properties of the two-step estimator and the oracle property of the first-step estimator when the number of parameters diverges. The performances of our method are illustrated through simulations and financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

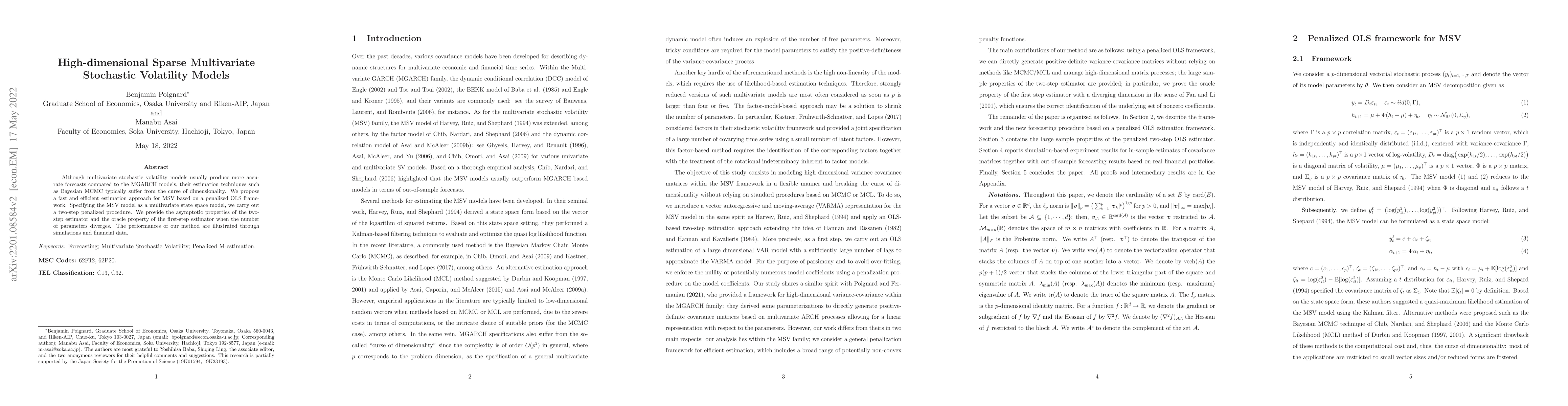

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFactor multivariate stochastic volatility models of high dimension

Benjamin Poignard, Manabu Asai

| Title | Authors | Year | Actions |

|---|

Comments (0)