Summary

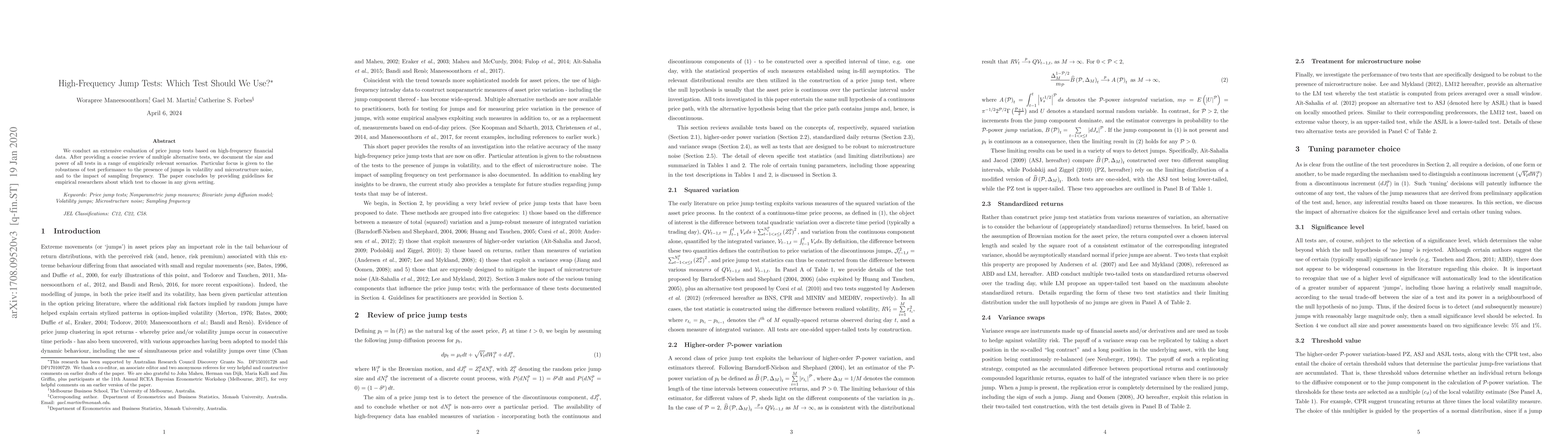

We conduct an extensive evaluation of price jump tests based on high-frequency financial data. After providing a concise review of multiple alternative tests, we document the size and power of all tests in a range of empirically relevant scenarios. Particular focus is given to the robustness of test performance to the presence of jumps in volatility and microstructure noise, and to the impact of sampling frequency. The paper concludes by providing guidelines for empirical researchers about which test to choose in any given setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)