Summary

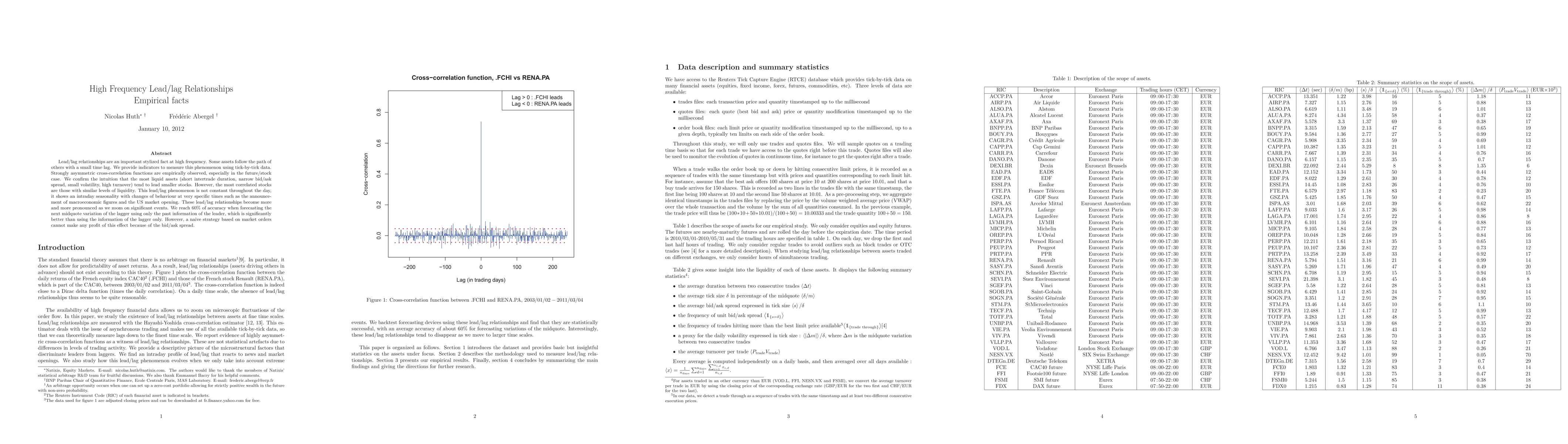

Lead/lag relationships are an important stylized fact at high frequency. Some assets follow the path of others with a small time lag. We provide indicators to measure this phenomenon using tick-by-tick data. Strongly asymmetric cross-correlation functions are empirically observed, especially in the future/stock case. We confirm the intuition that the most liquid assets (short intertrade duration, narrow bid/ask spread, small volatility, high turnover) tend to lead smaller stocks. However, the most correlated stocks are those with similar levels of liquidity. This lead/lag phenomenon is not constant throughout the day, it shows an intraday seasonality with changes of behaviour at very specific times such as the announcement of macroeconomic figures and the US market opening. These lead/lag relationships become more and more pronounced as we zoom on significant events. We reach 60% of accuracy when forecasting the next midquote variation of the lagger using only the past information of the leader, which is significantly better than using the information of the lagger only. However, a naive strategy based on market orders cannot make any profit of this effect because of the bid/ask spread.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)