Summary

This research presents a comprehensive framework for analyzing liquidity in financial markets, particularly in the context of high-frequency trading. By leveraging advanced machine learning classification techniques, including Logistic Regression, Support Vector Machine, and Random Forest, the study aims to predict minute-level price movements using an extensive set of liquidity metrics derived from the Trade and Quote (TAQ) data. The findings reveal that employing a broad spectrum of liquidity measures yields higher predictive accuracy compared to models utilizing a reduced subset of features. Key liquidity metrics, such as Liquidity Ratio, Flow Ratio, and Turnover, consistently emerged as significant predictors across all models, with the Random Forest algorithm demonstrating superior accuracy. This study not only underscores the critical role of liquidity in market stability and transaction costs but also highlights the complexities involved in short-interval market predictions. The research suggests that a comprehensive set of liquidity measures is essential for accurate prediction, and proposes future work to validate these findings across different stock datasets to assess their generalizability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

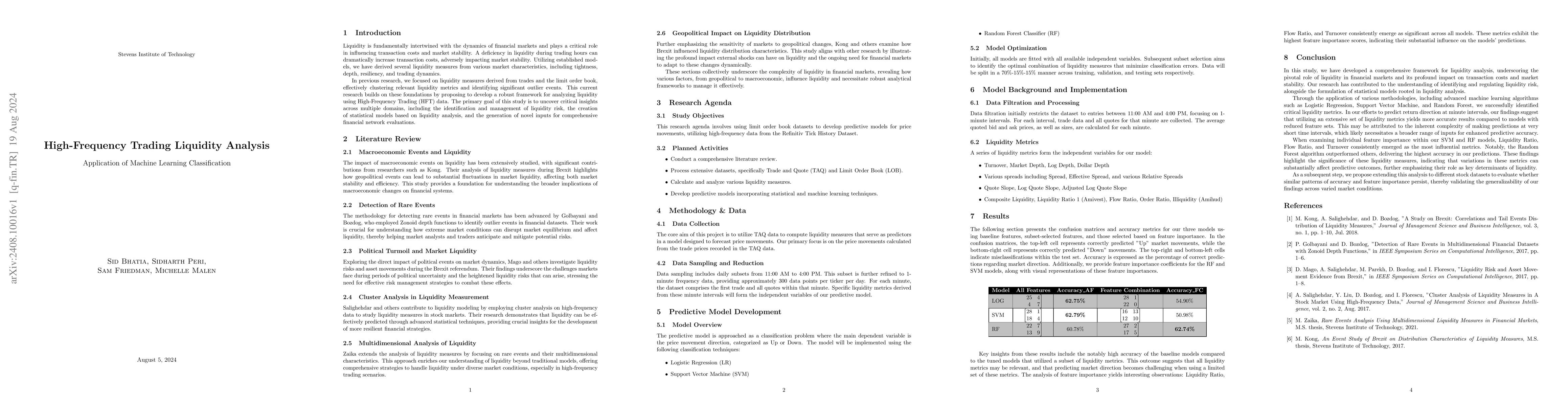

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan machine learning unlock new insights into high-frequency trading?

G. Ibikunle, B. Moews, K. Rzayev

No citations found for this paper.

Comments (0)