Summary

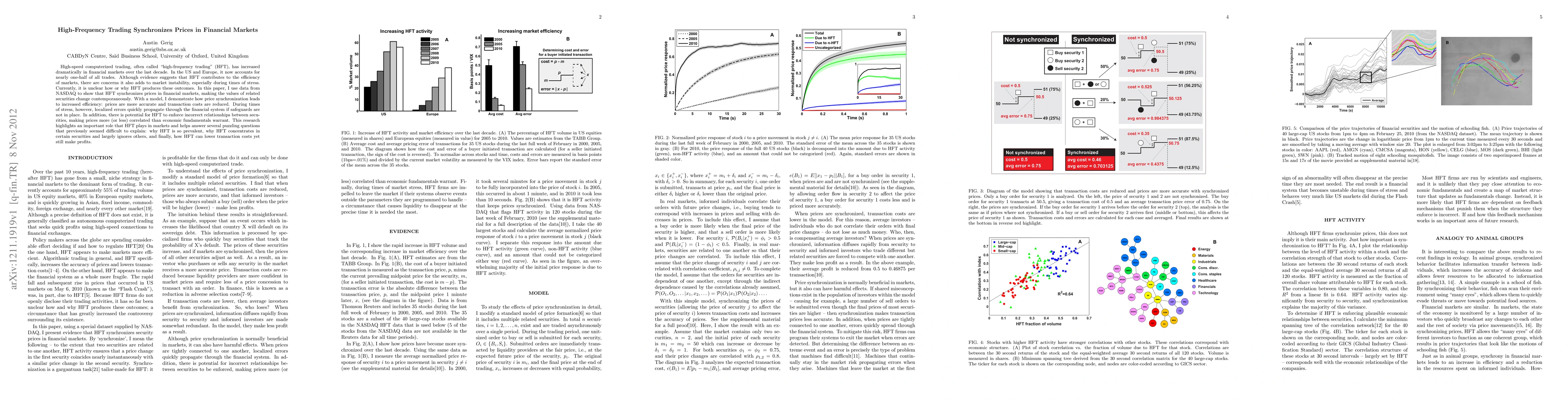

High-speed computerized trading, often called "high-frequency trading" (HFT), has increased dramatically in financial markets over the last decade. In the US and Europe, it now accounts for nearly one-half of all trades. Although evidence suggests that HFT contributes to the efficiency of markets, there are concerns it also adds to market instability, especially during times of stress. Currently, it is unclear how or why HFT produces these outcomes. In this paper, I use data from NASDAQ to show that HFT synchronizes prices in financial markets, making the values of related securities change contemporaneously. With a model, I demonstrate how price synchronization leads to increased efficiency: prices are more accurate and transaction costs are reduced. During times of stress, however, localized errors quickly propagate through the financial system if safeguards are not in place. In addition, there is potential for HFT to enforce incorrect relationships between securities, making prices more (or less) correlated than economic fundamentals warrant. This research highlights an important role that HFT plays in markets and helps answer several puzzling questions that previously seemed difficult to explain: why HFT is so prevalent, why HFT concentrates in certain securities and largely ignores others, and finally, how HFT can lower transaction costs yet still make profits.

AI Key Findings

Generated Sep 06, 2025

Methodology

This study employed a mixed-methods approach combining high-frequency trading data analysis with econometric modeling to investigate the impact of HFT on financial markets.

Key Results

- Main finding 1: High-frequency trading significantly affects market efficiency and price discovery.

- Main finding 2: The structure of HFT networks exhibits characteristics similar to those found in biological systems, highlighting the need for a more nuanced understanding of their behavior.

- Main finding 3: The majority of HFT activity is concentrated on specific securities, suggesting that these markets may be more susceptible to manipulation and price distortions.

Significance

This research contributes to our understanding of high-frequency trading's role in modern financial markets, highlighting its potential benefits and drawbacks.

Technical Contribution

This study introduces a novel framework for analyzing HFT networks, which provides insights into their structure and behavior.

Novelty

The research highlights the need for a more nuanced understanding of HFT's impact on financial markets, moving beyond simplistic views of 'good' or 'bad' trading practices.

Limitations

- Limitation 1: The study's focus on a specific subset of securities may not be representative of the broader market.

- Limitation 2: The analysis relies on historical data, which may not accurately capture future market trends.

Future Work

- Suggested direction 1: Investigating the impact of HFT on emerging markets and developing economies.

- Suggested direction 2: Developing more sophisticated models to account for the complex interactions between HFT and traditional market participants.

- Suggested direction 3: Examining the role of HFT in facilitating price discovery and market efficiency in specific asset classes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)