Summary

We propose a new method of measuring the third and fourth moments of return distribution based on quadratic variation method when the return process is assumed to have zero drift. The realized third and fourth moments variations computed from high frequency return series are good approximations to corresponding actual moments of the return distribution. An investor holding an asset with skewed or fat-tailed distribution is able to hedge the tail risk by contracting the third or fourth moment swap under which the float leg of realized variation and the predetermined fixed leg are exchanged. Thus constructed portfolio follows more Gaussian-like distribution and hence the investor effectively hedge the tail risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

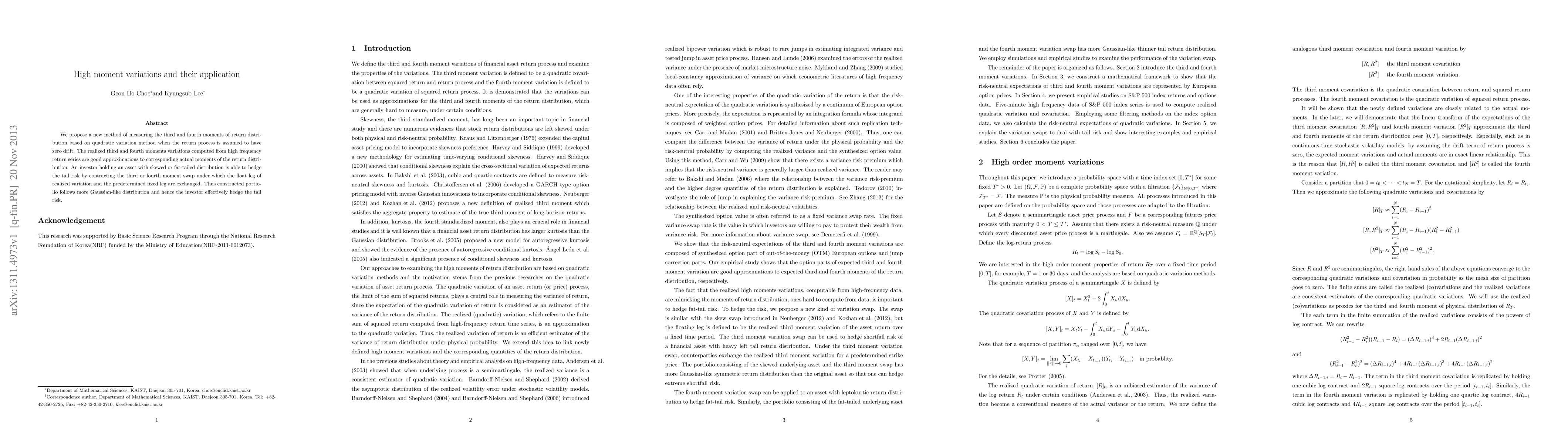

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)