Summary

We derive high-order compact finite difference schemes for option pricing in stochastic volatility models on non-uniform grids. The schemes are fourth-order accurate in space and second-order accurate in time for vanishing correlation. In our numerical study we obtain high-order numerical convergence also for non-zero correlation and non-smooth payoffs which are typical in option pricing. In all numerical experiments a comparative standard second-order discretisation is significantly outperformed. We conduct a numerical stability study which indicates unconditional stability of the scheme.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

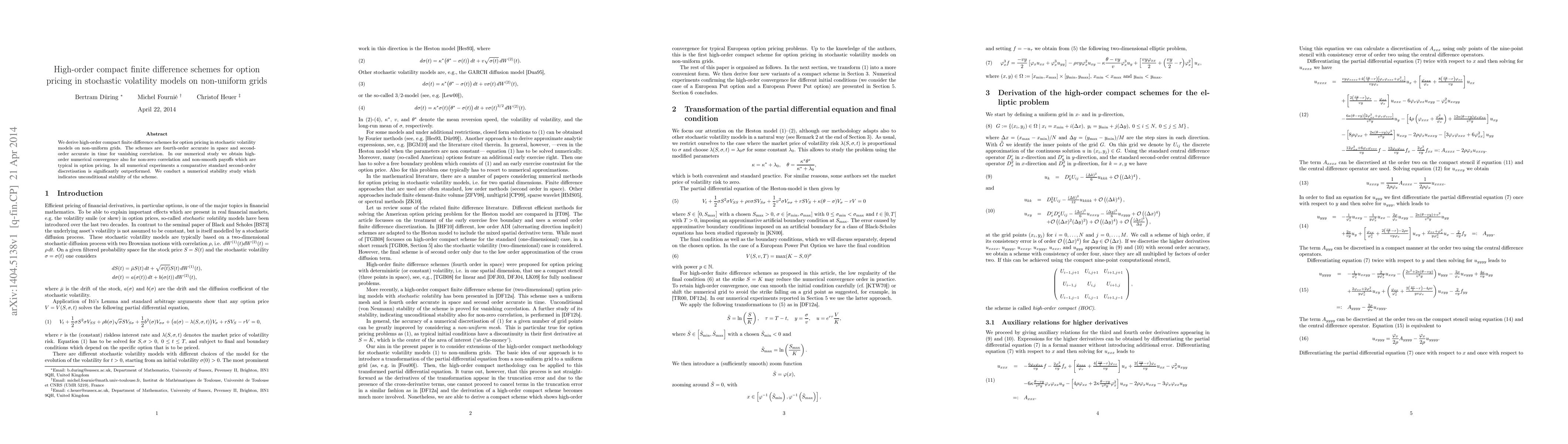

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime-adaptive high-order compact finite difference schemes for option pricing in a family of stochastic volatility models

Bertram Düring, Christof Heuer

| Title | Authors | Year | Actions |

|---|

Comments (0)