Summary

We present a high-order compact finite difference approach for a class of parabolic partial differential equations with time and space dependent coefficients as well as with mixed second-order derivative terms in $n$ spatial dimensions. Problems of this type arise frequently in computational fluid dynamics and computational finance. We derive general conditions on the coefficients which allow us to obtain a high-order compact scheme which is fourth-order accurate in space and second-order accurate in time. Moreover, we perform a thorough von Neumann stability analysis of the Cauchy problem in two and three spatial dimensions for vanishing mixed derivative terms, and also give partial results for the general case. The results suggest unconditional stability of the scheme. As an application example we consider the pricing of European Power Put Options in the multidimensional Black-Scholes model for two and three underlying assets. Due to the low regularity of typical initial conditions we employ the smoothing operators of Kreiss et al. to ensure high-order convergence of the approximations of the smoothed problem to the true solution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

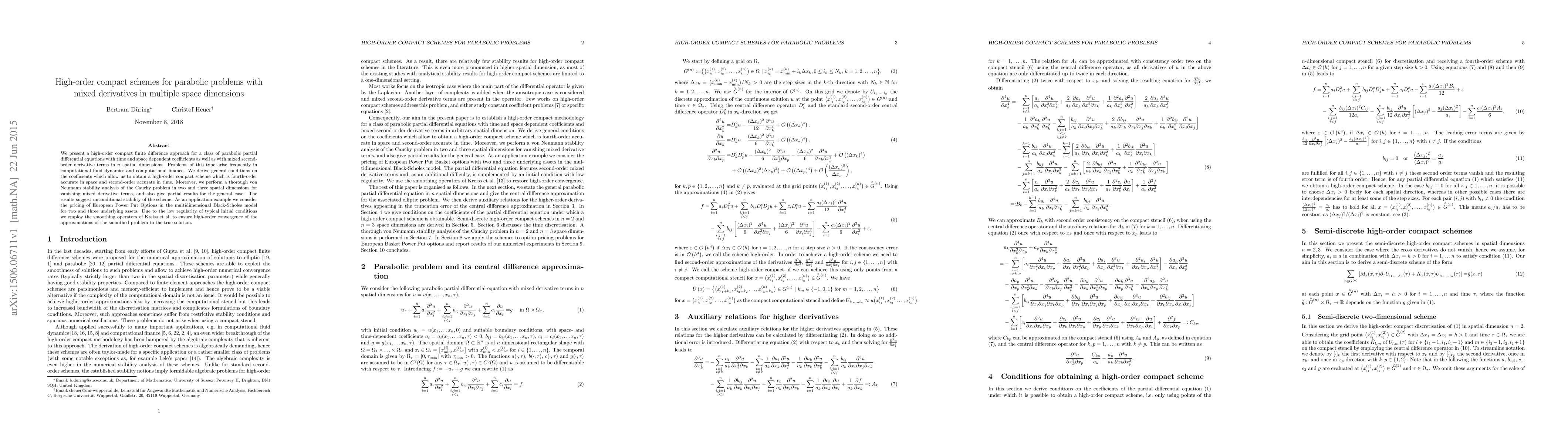

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)