Summary

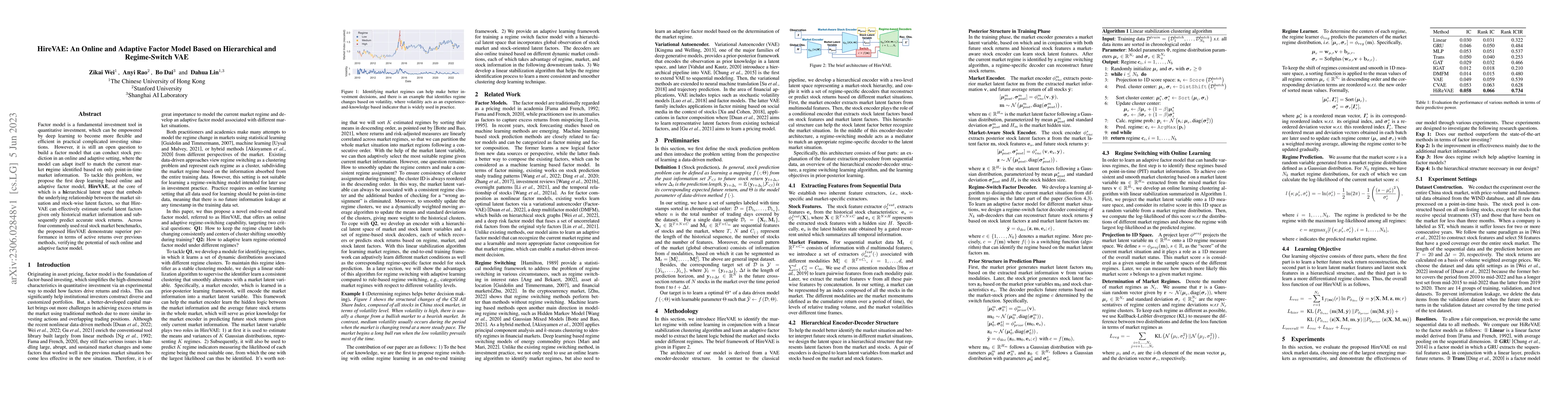

Factor model is a fundamental investment tool in quantitative investment, which can be empowered by deep learning to become more flexible and efficient in practical complicated investing situations. However, it is still an open question to build a factor model that can conduct stock prediction in an online and adaptive setting, where the model can adapt itself to match the current market regime identified based on only point-in-time market information. To tackle this problem, we propose the first deep learning based online and adaptive factor model, HireVAE, at the core of which is a hierarchical latent space that embeds the underlying relationship between the market situation and stock-wise latent factors, so that HireVAE can effectively estimate useful latent factors given only historical market information and subsequently predict accurate stock returns. Across four commonly used real stock market benchmarks, the proposed HireVAE demonstrate superior performance in terms of active returns over previous methods, verifying the potential of such online and adaptive factor model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)