Authors

Summary

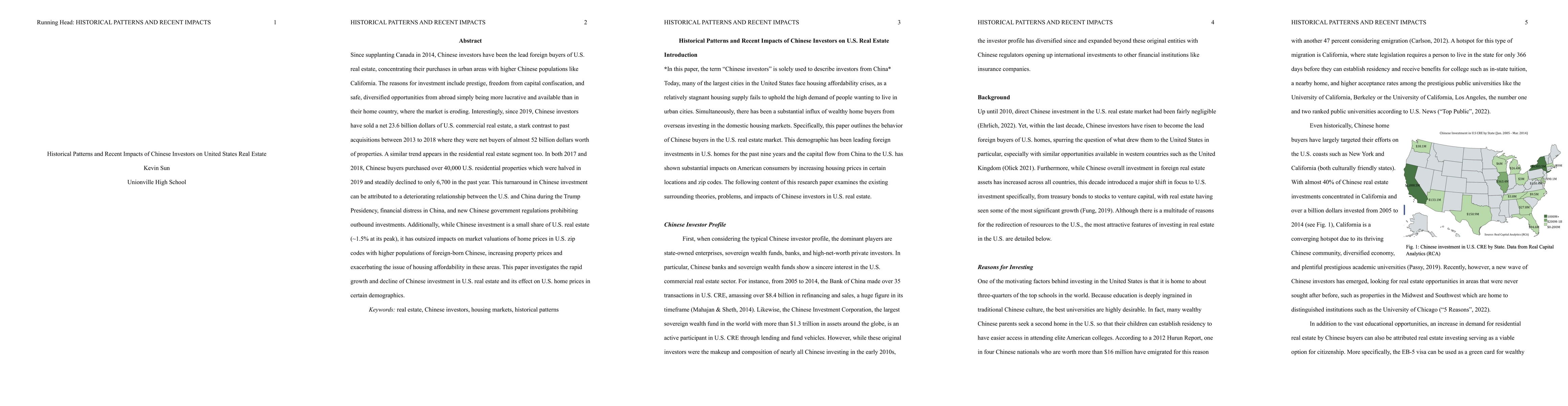

Since supplanting Canada in 2014, Chinese investors have been the lead foreign buyers of U.S. real estate, concentrating their purchases in urban areas with higher Chinese populations like California. The reasons for investment include prestige, freedom from capital confiscation, and safe, diversified opportunities from abroad simply being more lucrative and available than in their home country, where the market is eroding. Interestingly, since 2019, Chinese investors have sold a net 23.6 billion dollars of U.S. commercial real estate, a stark contrast to past acquisitions between 2013 to 2018 where they were net buyers of almost 52 billion dollars worth of properties. A similar trend appears in the residential real estate segment too. In both 2017 and 2018, Chinese buyers purchased over 40,000 U.S. residential properties which were halved in 2019 and steadily declined to only 6,700 in the past year. This turnaround in Chinese investment can be attributed to a deteriorating relationship between the U.S. and China during the Trump Presidency, financial distress in China, and new Chinese government regulations prohibiting outbound investments. Additionally, while Chinese investment is a small share of U.S. real estate (~1.5% at its peak), it has outsized impacts on market valuations of home prices in U.S. zip codes with higher populations of foreign-born Chinese, increasing property prices and exacerbating the issue of housing affordability in these areas. This paper investigates the rapid growth and decline of Chinese investment in U.S. real estate and its effect on U.S. home prices in certain demographics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)