Summary

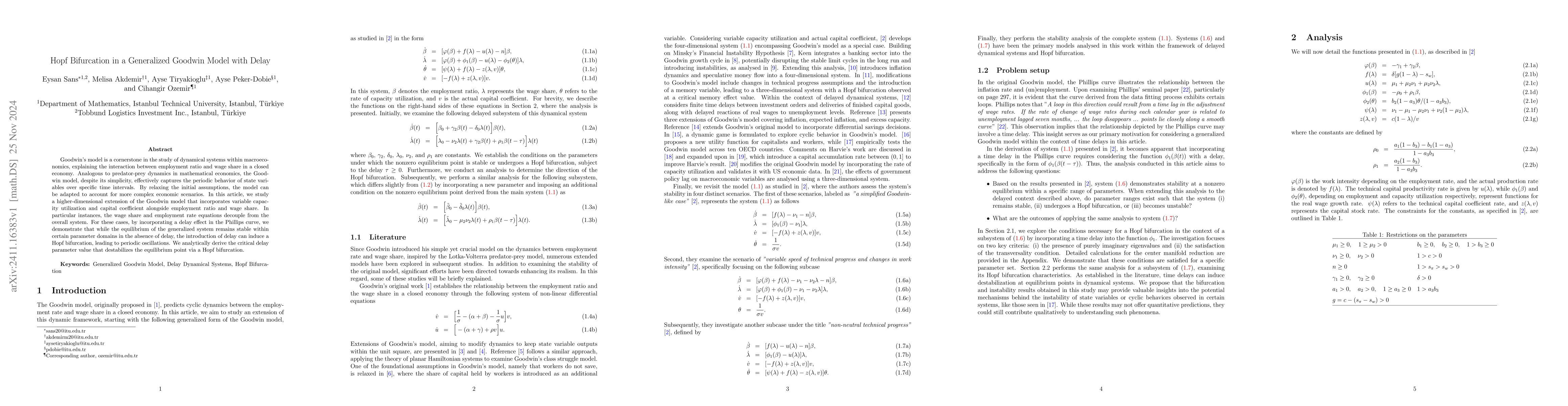

Goodwin's model is a cornerstone in the study of dynamical systems within macroeconomics, explaining the interaction between employment ratio and wage share in a closed economy. Analogous to predator-prey dynamics in mathematical economics, the Goodwin model, despite its simplicity, effectively captures the periodic behavior of state variables over specific time intervals. By relaxing the initial assumptions, the model can be adapted to account for more complex economic scenarios. In this article, we study a higher-dimensional extension of the Goodwin model that incorporates variable capacity utilization and capital coefficient alongside employment ratio and wage share. In particular instances, the wage share and employment rate equations decouple from the overall system. For these cases, by incorporating a delay effect in the Phillips curve, we demonstrate that while the equilibrium of the generalized system remains stable within certain parameter domains in the absence of delay, the introduction of delay can induce a Hopf bifurcation, leading to periodic oscillations. We analytically derive the critical delay parameter value that destabilizes the equilibrium point via a Hopf bifurcation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersBifurcation Analysis of Generalized Hopf Bifurcation in Ordinary and Delay Differential Equations

M. M. Bosschaert, Yu. A. Kuznetsov, N. A. M. Delmeire

No citations found for this paper.

Comments (0)