Summary

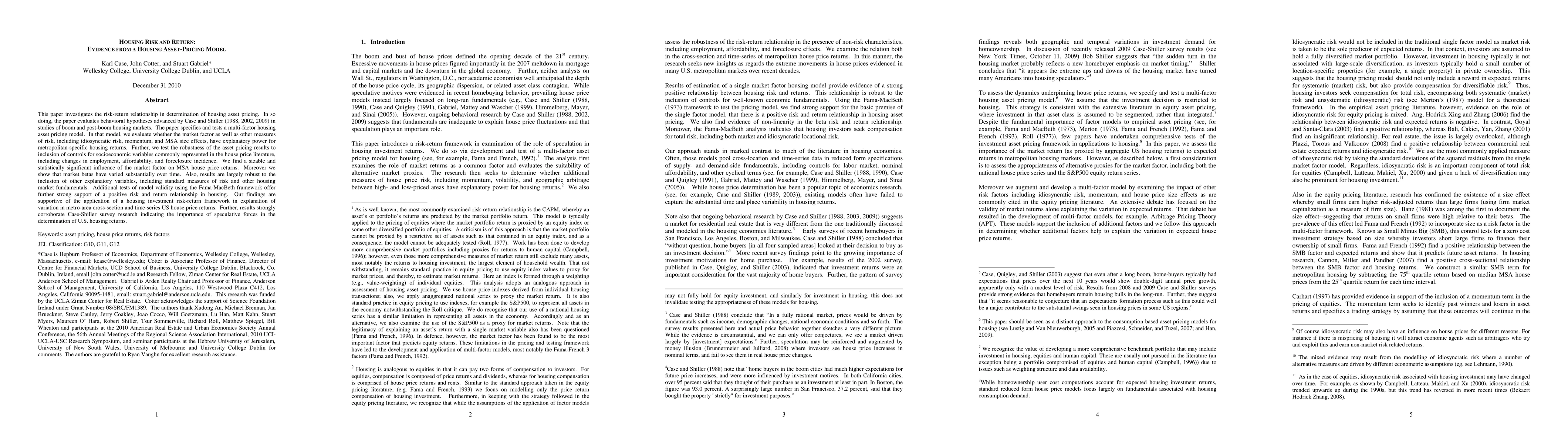

This paper investigates the risk-return relationship in determination of housing asset pricing. In so doing, the paper evaluates behavioral hypotheses advanced by Case and Shiller (1988, 2002, 2009) in studies of boom and post-boom housing markets. The paper specifies and tests a multi-factor housing asset pricing model. In that model, we evaluate whether the market factor as well as other measures of risk, including idiosyncratic risk, momentum, and MSA size effects, have explanatory power for metropolitan-specific housing returns. Further, we test the robustness of the asset pricing results to inclusion of controls for socioeconomic variables commonly represented in the house price literature, including changes in employment, affordability, and foreclosure incidence. We find a sizable and statistically significant influence of the market factor on MSA house price returns. Moreover we show that market betas have varied substantially over time. Also, results are largely robust to the inclusion of other explanatory variables, including standard measures of risk and other housing market fundamentals. Additional tests of model validity using the Fama-MacBeth framework offer further strong support of a positive risk and return relationship in housing. Our findings are supportive of the application of a housing investment risk-return framework in explanation of variation in metro-area cross-section and time-series US house price returns. Further, results strongly corroborate Case-Shiller survey research indicating the importance of speculative forces in the determination of U.S. housing returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)