Summary

We consider the problem of risk diversification in complex networks. Nodes represent e.g. financial actors, whereas weighted links represent e.g. financial obligations (credits/debts). Each node has a risk to fail because of losses resulting from defaulting neighbors, which may lead to large failure cascades. Classical risk diversification strategies usually neglect network effects and therefore suggest that risk can be reduced if possible losses (i.e., exposures) are split among many neighbors (exposure diversification, ED). But from a complex networks perspective diversification implies higher connectivity of the system as a whole which can also lead to increasing failure risk of a node. To cope with this, we propose a different strategy (damage diversification, DD), i.e. the diversification of losses that are imposed on neighboring nodes as opposed to losses incurred by the node itself. Here, we quantify the potential of DD to reduce systemic risk in comparison to ED. For this, we develop a branching process approximation that we generalize to weighted networks with (almost) arbitrary degree and weight distributions. This allows us to identify systemically relevant nodes in a network even if their directed weights differ strongly. On the macro level, we provide an analytical expression for the average cascade size, to quantify systemic risk. Furthermore, on the meso level we calculate failure probabilities of nodes conditional on their system relevance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

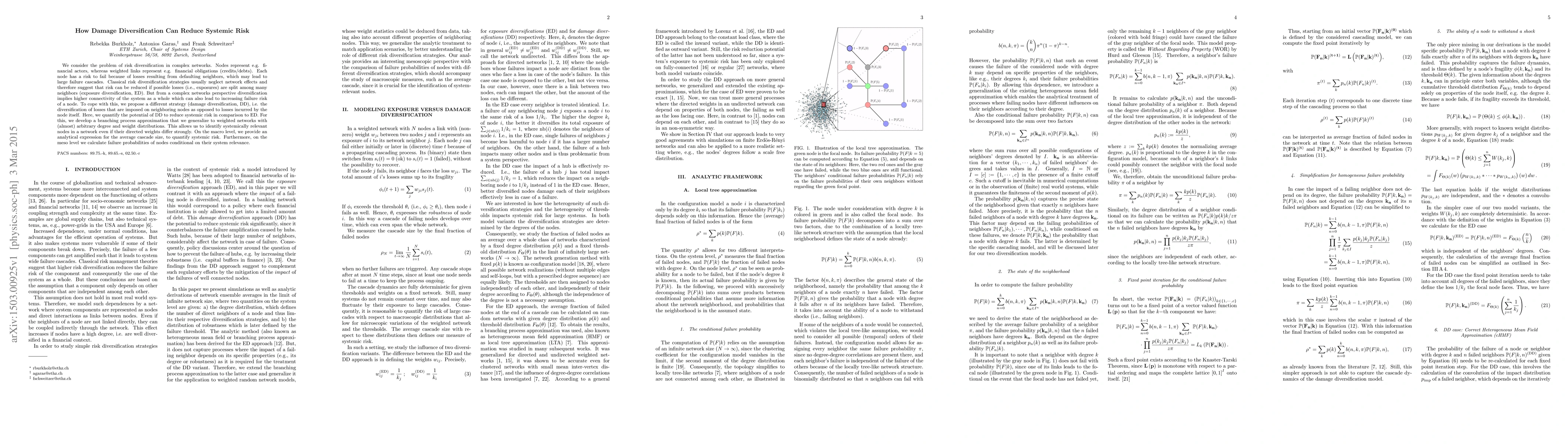

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)