Authors

Summary

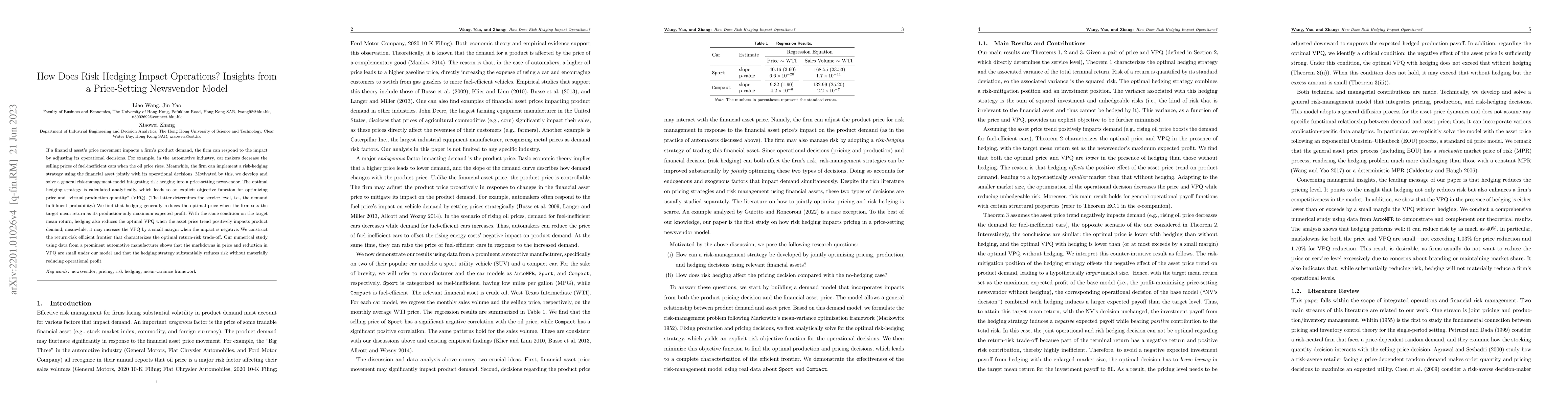

If a financial asset's price movement impacts a firm's product demand, the firm can respond to the impact by adjusting its operational decisions. For example, in the automotive industry, car makers decrease the selling prices of fuel-inefficient cars when the oil price rises. Meanwhile, the firm can implement a risk-hedging strategy using the financial asset jointly with its operational decisions. Motivated by this, we develop and solve a general risk-management model integrating risk hedging into a price-setting newsvendor. The optimal hedging strategy is calculated analytically, which leads to an explicit objective function for optimizing price and ``virtual production quantity'' (VPQ). (The latter determines the service level, i.e., the demand fulfillment probability.) We find that hedging generally reduces the optimal price {when the firm sets the target mean return as its production-only maximum expected profit. With the same condition on the target mean return}, hedging also reduces the optimal VPQ when the asset price trend positively impacts product demand; meanwhile, it may increase the VPQ by a small margin when the impact is negative. We construct the return-risk efficient frontier that characterizes the optimal return-risk trade-off. Our numerical study using data from a prominent automotive manufacturer shows that the markdowns in price and reduction in VPQ are small under our model and that the hedging strategy substantially reduces risk without materially reducing operational profit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)