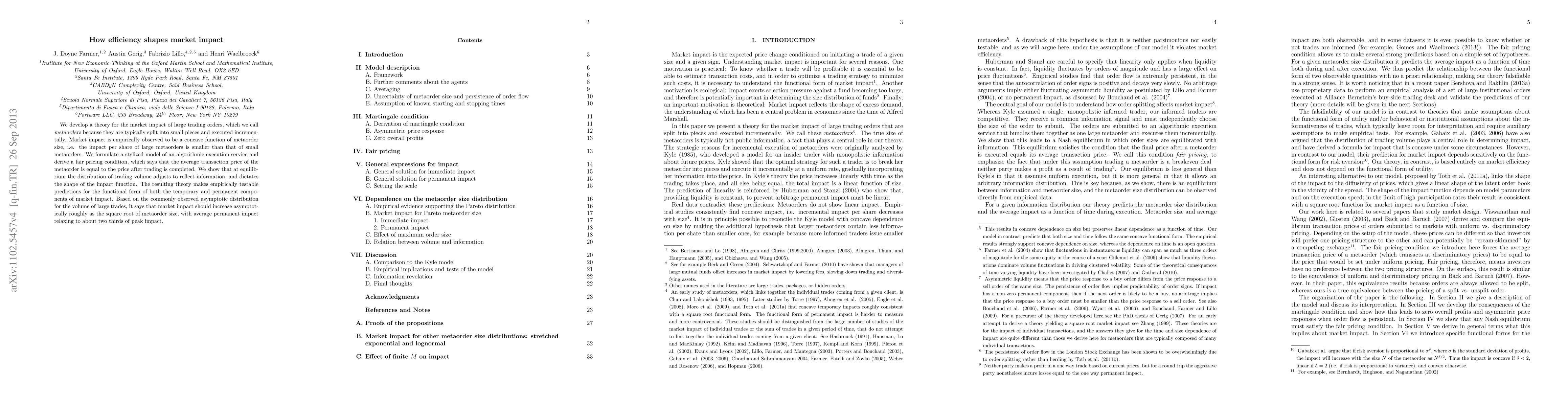

Summary

We develop a theory for the market impact of large trading orders, which we call metaorders because they are typically split into small pieces and executed incrementally. Market impact is empirically observed to be a concave function of metaorder size, i.e., the impact per share of large metaorders is smaller than that of small metaorders. We formulate a stylized model of an algorithmic execution service and derive a fair pricing condition, which says that the average transaction price of the metaorder is equal to the price after trading is completed. We show that at equilibrium the distribution of trading volume adjusts to reflect information, and dictates the shape of the impact function. The resulting theory makes empirically testable predictions for the functional form of both the temporary and permanent components of market impact. Based on the commonly observed asymptotic distribution for the volume of large trades, it says that market impact should increase asymptotically roughly as the square root of metaorder size, with average permanent impact relaxing to about two thirds of peak impact.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDo price trajectory data increase the efficiency of market impact estimation?

Yuriy Nevmyvaka, Anderson Schneider, Fengpei Li et al.

How low-cost AI universal approximators reshape market efficiency

Paolo Barucca, Flaviano Morone

| Title | Authors | Year | Actions |

|---|

Comments (0)