Summary

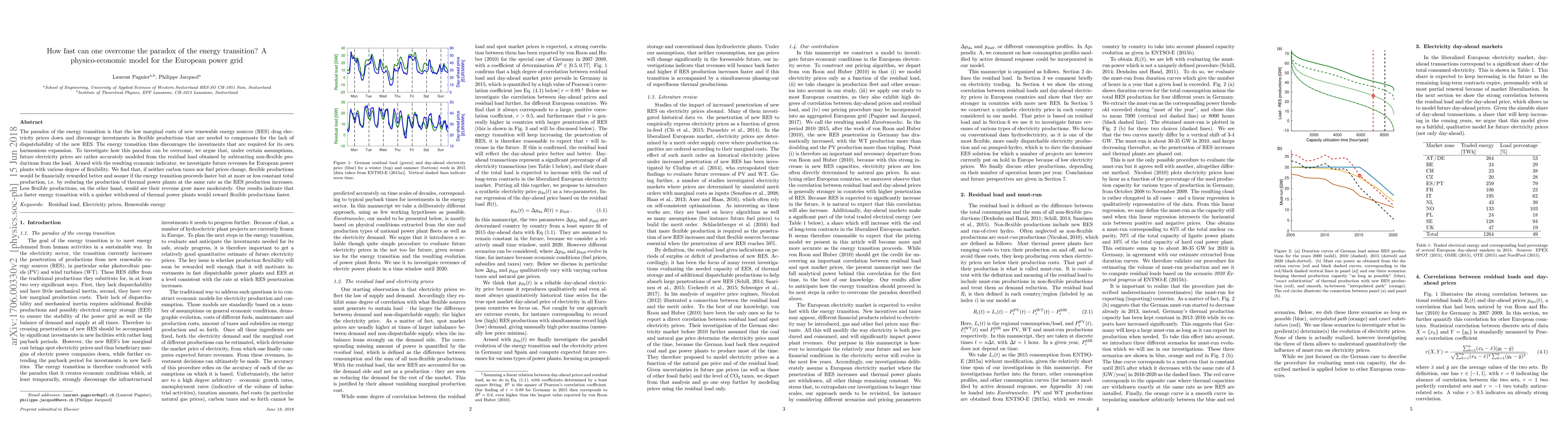

The paradox of the energy transition is that the low marginal costs of new renewable energy sources (RES) drag electricity prices down and discourage investments in flexible productions that are needed to compensate for the lack of dispatchability of the new RES. The energy transition thus discourages the investments that are required for its own harmonious expansion. To investigate how this paradox can be overcome, we argue that, under certain assumptions, future electricity prices are rather accurately modeled from the residual load obtained by subtracting non-flexible productions from the load. Armed with the resulting economic indicator, we investigate future revenues for European power plants with various degree of flexibility. We find that, if neither carbon taxes nor fuel prices change, flexible productions would be financially rewarded better and sooner if the energy transition proceeds faster but at more or less constant total production, i.e. by reducing the production of thermal power plants at the same rate as the RES production increases. Less flexible productions, on the other hand, would see their revenue grow more moderately. Our results indicate that a faster energy transition with a quicker withdrawal of thermal power plants would reward flexible productions faster.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting the power grid frequency of European islands

Veit Hagenmeyer, Ralf Mikut, Benjamin Schäfer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)