Summary

Noncooperative games with uncertain payoffs have been classically studied under the expected-utility theory framework, which relies on the strong assumption that agents behave rationally. However, simple experiments on human decision makers found them to be not fully rational, due to their subjective risk perception. Prospect theory was proposed as an empirically-grounded model to incorporate irrational behaviours into game-theoretic models. But, how prospect theory shapes the set of Nash equilibria when considering irrational agents, is still poorly understood. To this end, we study how prospect theoretic transformations may generate new equilibria while eliminating existing ones. Focusing on aggregative games, we show that capturing users' irrationality can preserve symmetric equilibria while causing the vanishing of asymmetric equilibria. Further, there exist value functions which map uncountable sets of equilibria in the expected-utility maximization framework to finite sets. This last result may shape some equilibrium selection theories for human-in-the-loop systems where computing a single equilibrium is insufficient and comparison of equilibria is needed.

AI Key Findings

Generated Jun 09, 2025

Methodology

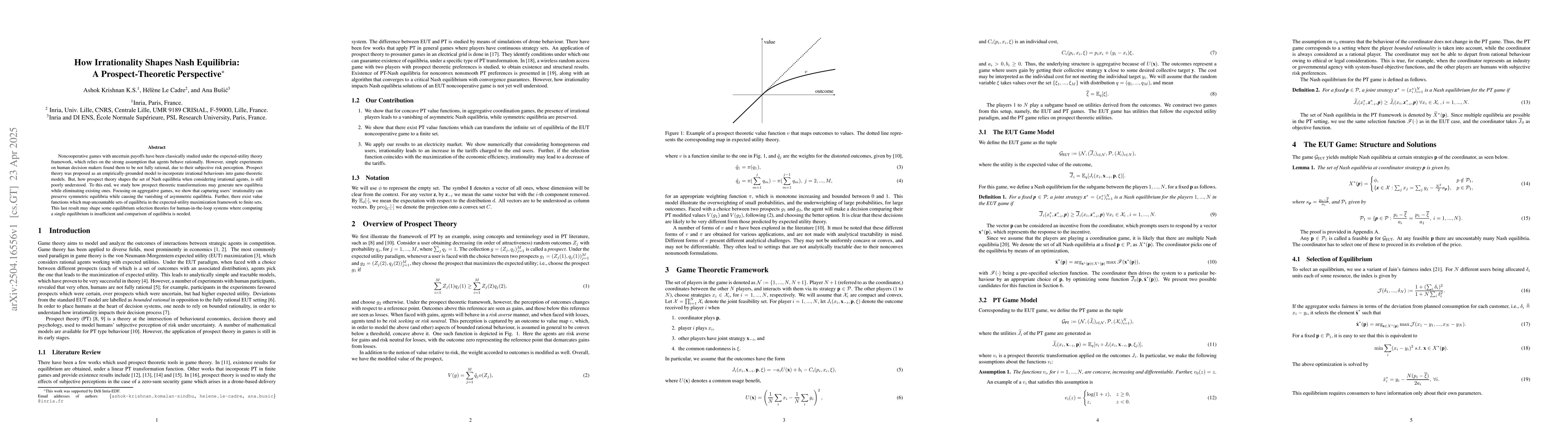

The research uses prospect theory to analyze how irrationality shapes Nash equilibria in aggregative games. It employs a distributed gradient play algorithm to simulate equilibria in a stylized electricity market setting.

Key Results

- Symmetrical equilibria are preserved while asymmetrical equilibria vanish under specific value function choices.

- Prospect-theoretic transformations reduce the cardinality of existing Nash equilibria in many cases.

- Irrational behavior can drive fixed prices up or down, depending on the N+1-player's selection function in a stylized electricity market.

Significance

This study is significant as it provides insights into how human irrationality, as modeled by prospect theory, affects market equilibria, which can inform the design of more realistic economic models and policies.

Technical Contribution

The paper presents a framework for integrating prospect theory into game-theoretic models, specifically focusing on aggregative games and demonstrating its effects on Nash equilibria.

Novelty

The work distinguishes itself by explicitly linking prospect theory to Nash equilibria in game theory, providing both theoretical insights and numerical simulations to illustrate the impact of irrationality on market equilibria.

Limitations

- The research focuses on aggregative games and stylized electricity market models, so generalizability to other game types or real-world complexities may be limited.

- Numerical simulations are used extensively, and analytical results for more general prospect-theoretic equilibria are not provided.

Future Work

- Extend the analysis to more general forms of prospect-theoretic transformations and equilibrium characterization.

- Investigate the global convergence properties of gradient play algorithms for prospect-theoretic games.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGame-Theoretical Perspectives on Active Equilibria: A Preferred Solution Concept over Nash Equilibria

Jakob N. Foerster, Jonathan P. How, Miao Liu et al.

No citations found for this paper.

Comments (0)