Summary

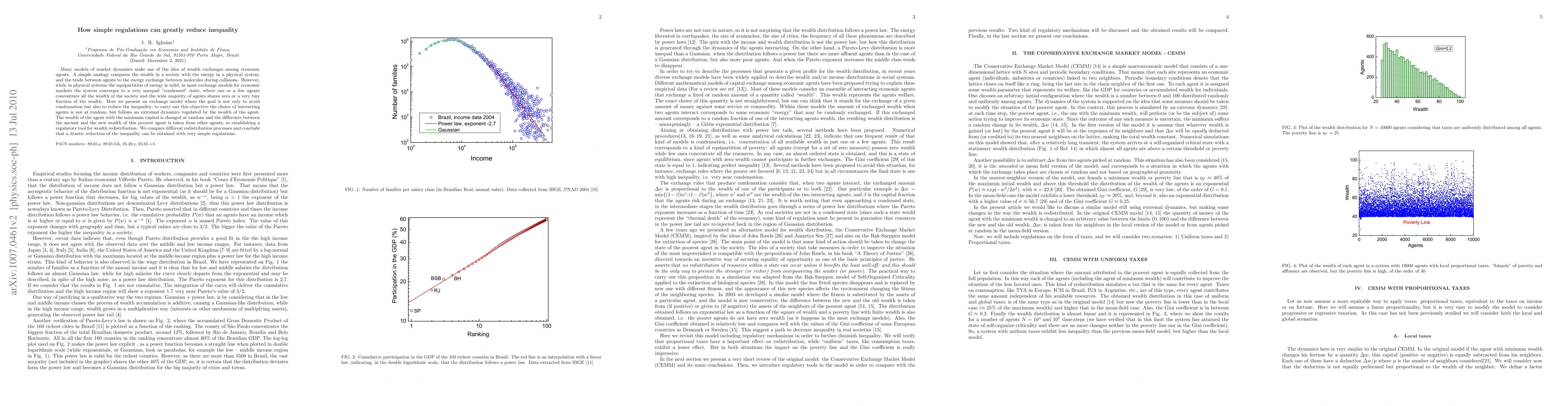

Many models of market dynamics make use of the idea of wealth exchanges among economic agents. A simple analogy compares the wealth in a society with the energy in a physical system, and the trade between agents to the energy exchange between molecules during collisions. However, while in physical systems the equipartition of energy is valid, in most exchange models for economic markets the system converges to a very unequal "condensed" state, where one or a few agents concentrate all the wealth of the society and the wide majority of agents shares zero or a very tiny fraction of the wealth. Here we present an exchange model where the goal is not only to avoid condensation but also to reduce the inequality; to carry out this objective the choice of interacting agents is not at random, but follows an extremal dynamics regulated by the wealth of the agent. The wealth of the agent with the minimum capital is changed at random and the difference between the ancient and the new wealth of this poorest agent is taken from other agents, so establishing a regulatory tool for wealth redistribution. We compare different redistribution processes and conclude that a drastic reduction of the inequality can be obtained with very simple regulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNeutron Tagging Can Greatly Reduce Spallation Backgrounds in Super-Kamiokande

John F. Beacom, Obada Nairat, Shirley Weishi Li

| Title | Authors | Year | Actions |

|---|

Comments (0)