Summary

The seller of an asset has the option to buy hard information about the value of the asset from an intermediary. The seller can then disclose the acquired information before selling the asset in a competitive market. We study how the intermediary designs and sells hard information to robustly maximize her revenue across all equilibria. Even though the intermediary could use an accurate test that reveals the asset's value, we show that robust revenue maximization leads to a noisy test with a continuum of possible scores that are distributed exponentially. In addition, the intermediary always charges the seller for disclosing the test score to the market, but not necessarily for running the test. This enables the intermediary to robustly appropriate a significant share of the surplus resulting from the asset sale even though the information generated by the test provides no social value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

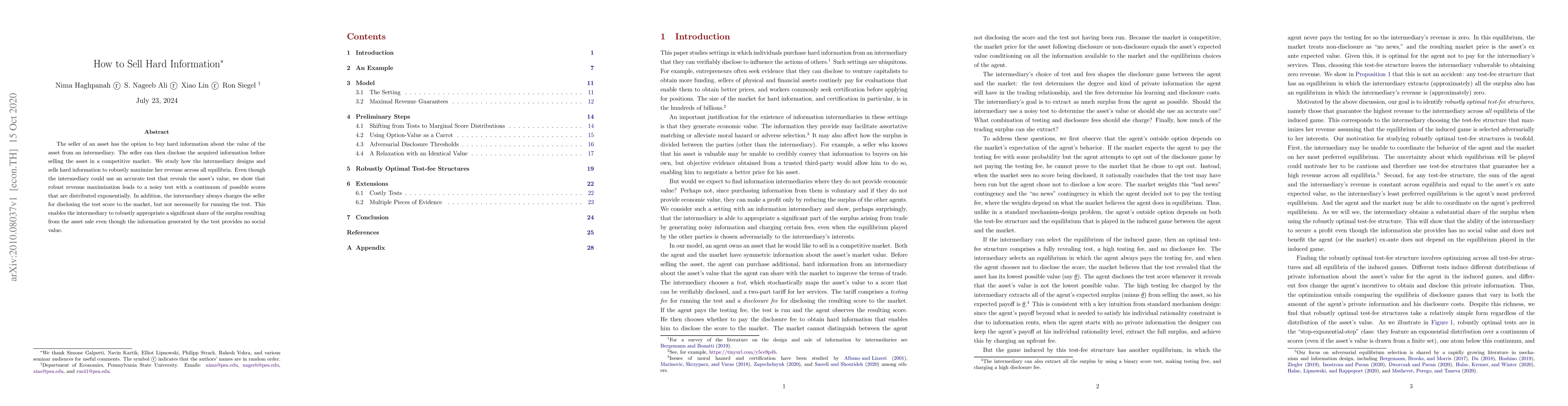

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAgent-Designed Contracts: How to Sell Hidden Actions

Andrea Celli, Matteo Castiglioni, Martino Bernasconi

| Title | Authors | Year | Actions |

|---|

Comments (0)