Summary

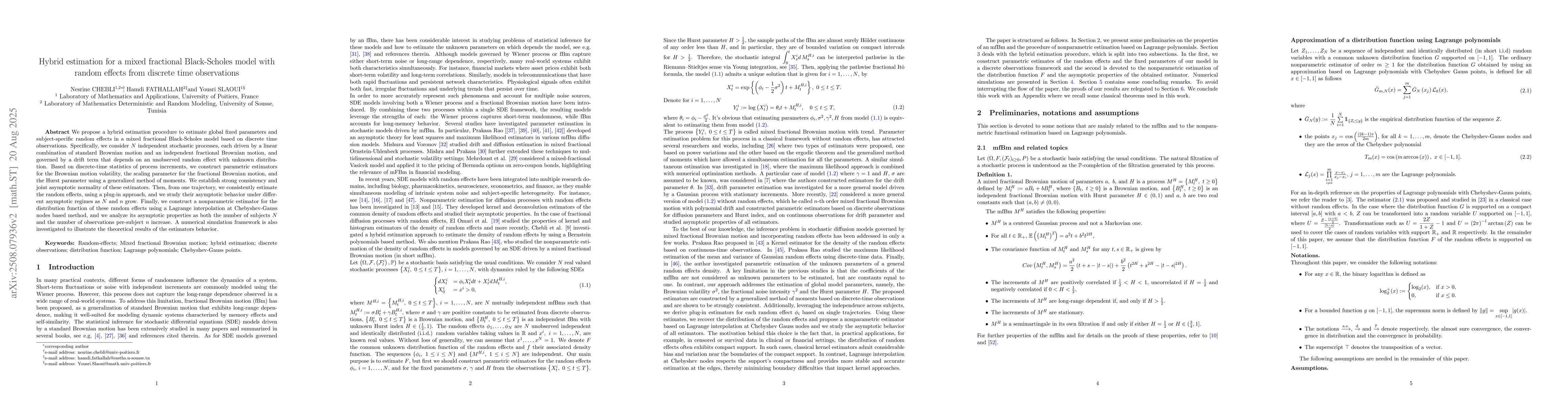

We propose a hybrid estimation procedure to estimate global fixed parameters and subject-specific random effects in a mixed fractional Black-Scholes model based on discrete time observations. Specifically, we consider $N$ independent stochastic processes, each driven by a linear combination of standard Brownian motion and an independent fractional Brownian motion, and governed by a drift term that depends on an unobserved random effect with unknown distribution. Based on discrete-time statistics of process increments, we construct parametric estimators for the Brownian motion volatility, the scaling parameter for the fractional Brownian motion, and the Hurst parameter using a generalized method of moments. We establish strong consistency and joint asymptotic normality of these estimators. Then, from one trajectory, we consistently estimate the random effects, using a plug-in approach, and we study their asymptotic behavior under different asymptotic regimes as $N$ and $n$ grow. Finally, we construct a nonparametric estimator for the distribution function of these random effects using a Lagrange interpolation at Chebyshev-Gauss nodes based method, and we analyze its asymptotic properties as both the number of subjects $N$ and the number of observations per-subject $n$ increase. A numerical simulation framework is also investigated to illustrate the theoretical results of the estimators behavior.

AI Key Findings

Generated Aug 12, 2025

Methodology

The research proposes a hybrid estimation procedure for a mixed fractional Black-Scholes model, incorporating global fixed parameters and subject-specific random effects using discrete time observations.

Key Results

- Development of consistent and asymptotically normal estimators for model fixed parameters and random effects.

- Introduction of a nonparametric estimator for the distribution function of random effects using Lagrange interpolation at Chebyshev-Gauss nodes.

- Numerical simulations validate the theoretical results of the estimators' behavior.

Significance

This work is significant for financial modeling, as it provides a robust estimation framework for mixed fractional Black-Scholes models, which are more realistic than traditional models by accounting for random effects and fractional Brownian motion.

Technical Contribution

The paper introduces a novel hybrid estimation approach combining moment-based statistics and discrete observations, leading to consistent and asymptotically normal estimators for both fixed parameters and random effects.

Novelty

The research distinguishes itself by addressing the estimation of random effects' distribution function in mixed fractional Black-Scholes models, providing a comprehensive estimation framework that accounts for both global parameters and subject-specific random effects.

Limitations

- The study assumes stationary Gaussian sequences and specific conditions for the autocovariance function.

- The proposed method relies on asymptotic properties, which may not fully capture small-sample behavior.

Future Work

- Investigate the performance of the proposed estimators under more complex scenarios and non-Gaussian distributions.

- Explore the applicability of the method to other stochastic processes beyond the fractional Black-Scholes model.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRandom effects estimation in a fractional diffusion model based on continuous observations

Hamdi Fathallah, Nesrine Chebli, Yousri Slaoui

Discrete-time weak approximation of a Black-Scholes model with drift and volatility Markov switching

Yuliya Mishura, Vitaliy Golomoziy, Kamil Kladivko

A fast compact difference scheme with unequal time-steps for the tempered time-fractional Black-Scholes model

Hu Li, Jinfeng Zhou, Xian-Ming Gu et al.

Comments (0)