Summary

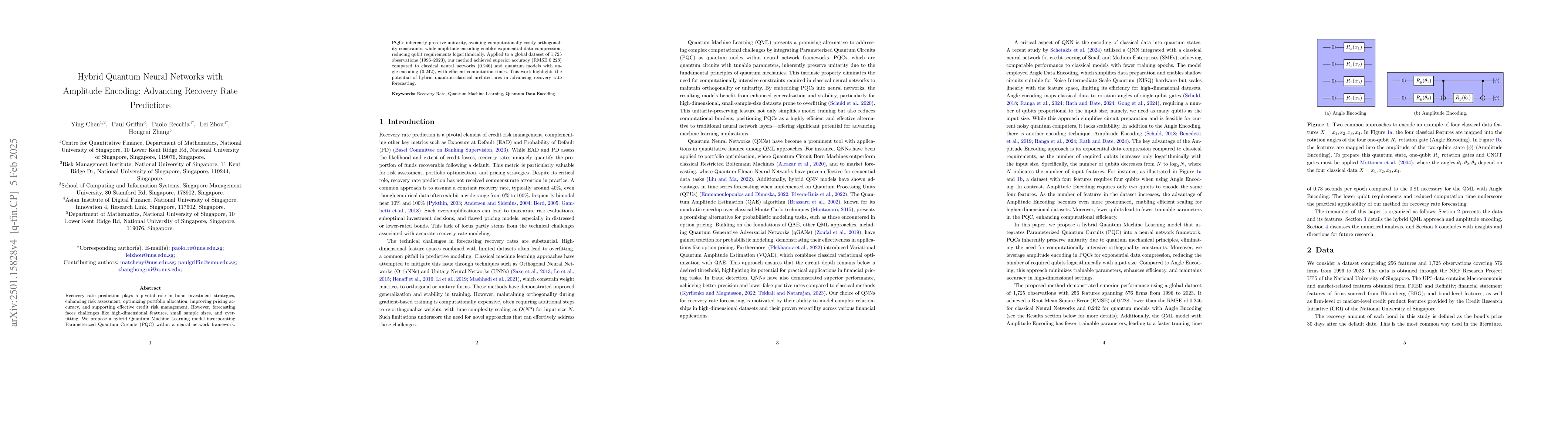

Recovery rate prediction plays a pivotal role in bond investment strategies, enhancing risk assessment, optimizing portfolio allocation, improving pricing accuracy, and supporting effective credit risk management. However, forecasting faces challenges like high-dimensional features, small sample sizes, and overfitting. We propose a hybrid Quantum Machine Learning model incorporating Parameterized Quantum Circuits (PQC) within a neural network framework. PQCs inherently preserve unitarity, avoiding computationally costly orthogonality constraints, while amplitude encoding enables exponential data compression, reducing qubit requirements logarithmically. Applied to a global dataset of 1,725 observations (1996-2023), our method achieved superior accuracy (RMSE 0.228) compared to classical neural networks (0.246) and quantum models with angle encoding (0.242), with efficient computation times. This work highlights the potential of hybrid quantum-classical architectures in advancing recovery rate forecasting.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research proposes a hybrid Quantum Machine Learning (QML) model combining Parameterized Quantum Circuits (PQC) within a neural network framework for recovery rate prediction in bond investments, utilizing amplitude encoding for efficient data compression.

Key Results

- The proposed QML model with amplitude encoding outperformed classical neural networks and quantum models with angle encoding in recovery rate prediction accuracy, achieving an RMSE of 0.228.

- The QML model demonstrated superior performance with fewer epochs and smaller standard deviation, indicating better stability and reduced overfitting.

- Comparative analysis showed that the QML model with amplitude encoding was statistically significantly better than classical FNN and QML with angle encoding models across most folds and training epochs.

- Despite initial lower RMSE in cross-validation, the QML model's performance improvement over XGBoost was not statistically significant due to higher variance in XGBoost.

- Leave-one-out cross-validation results indicated that the QML model outperformed XGBoost.

Significance

This research highlights the potential of hybrid quantum-classical architectures in advancing recovery rate forecasting, offering improved accuracy, stability, and efficiency compared to classical methods and existing quantum models.

Technical Contribution

The paper introduces a novel hybrid QML model using amplitude encoding for efficient data representation and reduced qubit requirements, demonstrating improved recovery rate prediction accuracy and stability compared to classical and existing quantum models.

Novelty

The research distinguishes itself by proposing a compact, efficient, and stable QML model for high-dimensional, small-sample tasks like recovery rate prediction, leveraging amplitude encoding and PQCs, which outperforms classical and other quantum-based approaches.

Limitations

- All QML models were developed and tested using quantum simulators, not real quantum hardware, which does not fully reflect the limitations of current quantum devices.

- The current implementation does not explicitly model or mitigate quantum noise effects like decoherence and gate errors, which can deteriorate model performance on real quantum hardware.

Future Work

- Explore more robust and efficient quantum model implementations, such as alternative encoding strategies (basis encoding, hybrid schemes), and dimensionality reduction techniques.

- Address hardware-related challenges, including circuit optimization, efficient gradient calculation methods, and noise mitigation strategies for reliable training and inference on real quantum devices.

- Investigate the economic implications of improved recovery rate predictions, such as informing profitable trading strategies and assessing the incremental economic value beyond existing credit risk models.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)