Summary

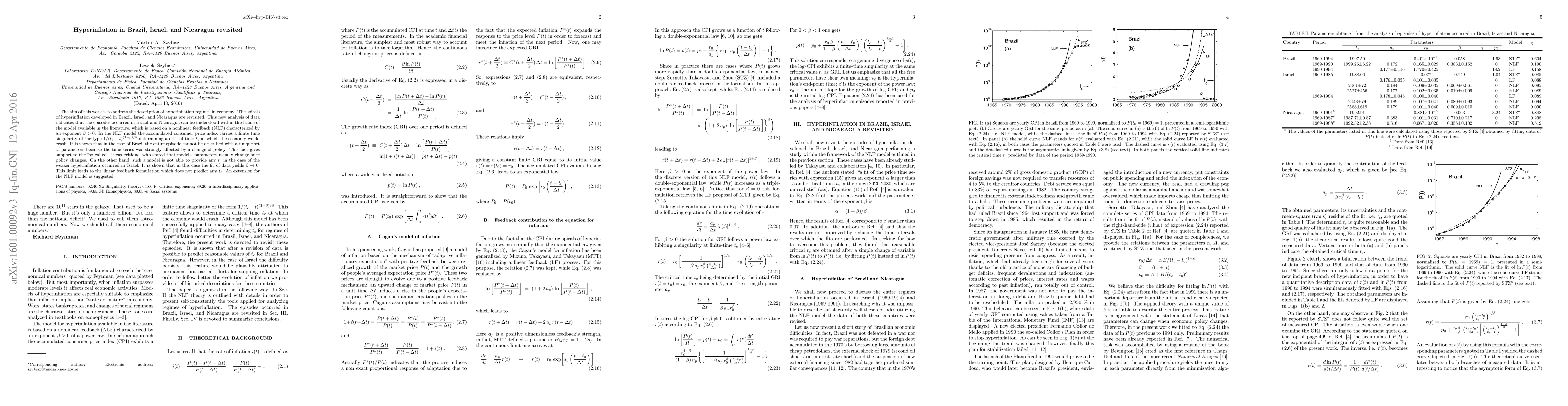

The aim of this work is to address the description of hyperinflation regimes in economy. The spirals of hyperinflation developed in Brazil, Israel, and Nicaragua are revisited. This new analysis of data indicates that the episodes occurred in Brazil and Nicaragua can be understood within the frame of the model available in the literature, which is based on a nonlinear feedback (NLF) characterized by an exponent $\beta>0$. In the NLF model the accumulated consumer price index carries a finite time singularity of the type $1/(t_c-t)^{(1- \beta)/\beta}$ determining a critical time $t_c$ at which the economy would crash. It is shown that in the case of Brazil the entire episode cannot be described with a unique set of parameters because the time series was strongly affected by a change of policy. This fact gives support to the "so called" Lucas critique, who stated that model's parameters usually change once policy changes. On the other hand, such a model is not able to provide any $t_c$ in the case of the weaker hyperinflation occurred in Israel. It is shown that in this case the fit of data yields $\beta \to 0$. This limit leads to the linear feedback formulation which does not predict any $t_c$. An extension for the NLF model is suggested.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)