Authors

Summary

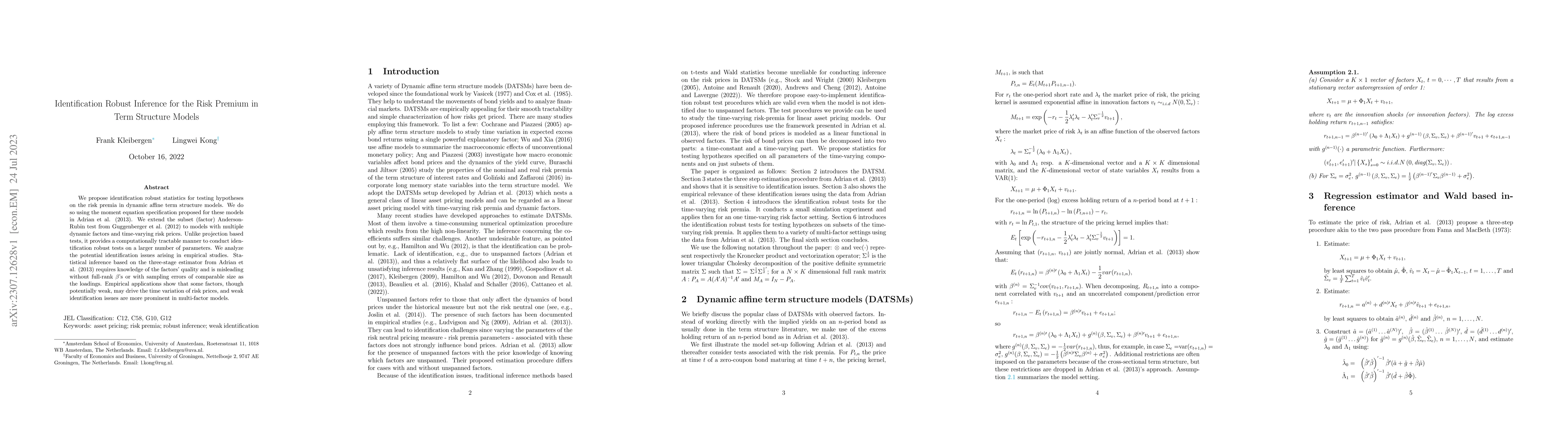

We propose identification robust statistics for testing hypotheses on the risk premia in dynamic affine term structure models. We do so using the moment equation specification proposed for these models in Adrian et al. (2013). We extend the subset (factor) Anderson-Rubin test from Guggenberger et al. (2012) to models with multiple dynamic factors and time-varying risk prices. Unlike projection-based tests, it provides a computationally tractable manner to conduct identification robust tests on a larger number of parameters. We analyze the potential identification issues arising in empirical studies. Statistical inference based on the three-stage estimator from Adrian et al. (2013) requires knowledge of the factors' quality and is misleading without full-rank beta's or with sampling errors of comparable size as the loadings. Empirical applications show that some factors, though potentially weak, may drive the time variation of risk prices, and weak identification issues are more prominent in multi-factor models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)