Authors

Summary

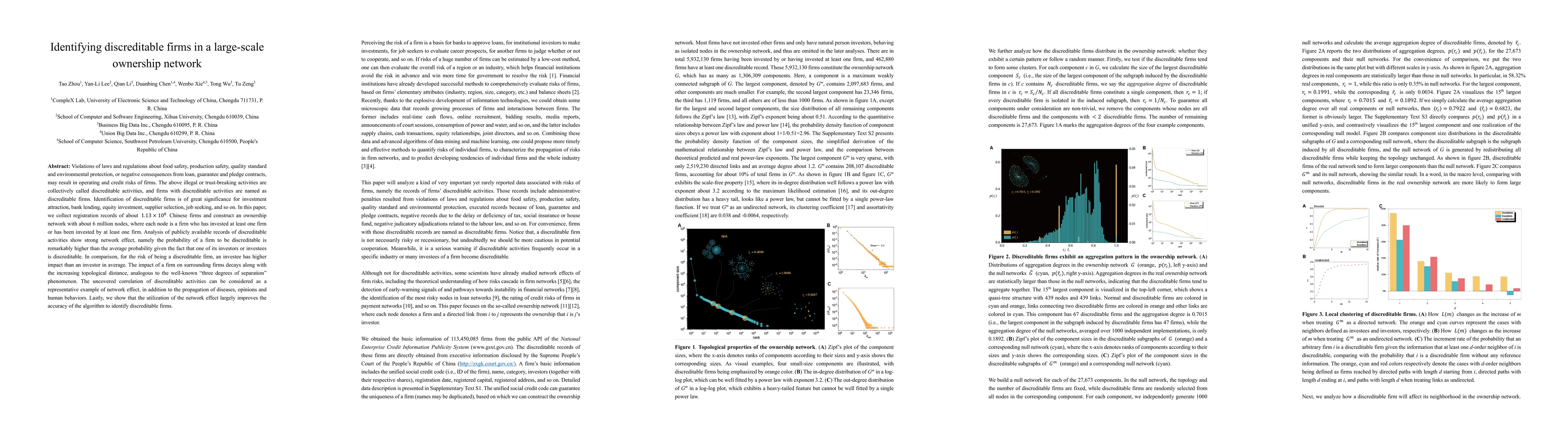

Violations of laws and regulations about food safety, production safety, quality standard and environmental protection, or negative consequences from loan, guarantee and pledge contracts, may result in operating and credit risks of firms. The above illegal or trust-breaking activities are collectively called discreditable activities, and firms with discreditable activities are named as discreditable firms. Identification of discreditable firms is of great significance for investment attraction, bank lending, equity investment, supplier selection, job seeking, and so on. In this paper, we collect registration records of about 113 million Chinese firms and construct an ownership network with about 6 million nodes, where each node is a firm who has invested at least one firm or has been invested by at least one firm. Analysis of publicly available records of discreditable activities show strong network effect, namely the probability of a firm to be discreditable is remarkably higher than the average probability given the fact that one of its investors or investees is discreditable. In comparison, for the risk of being a discreditable firm, an investee has higher impact than an investor in average. The impact of a firm on surrounding firms decays along with the increasing topological distance, analogous to the well-known "three degrees of separation" phenomenon. The uncovered correlation of discreditable activities can be considered as a representative example of network effect, in addition to the propagation of diseases, opinions and human behaviors. Lastly, we show that the utilization of the network effect largely improves the accuracy of the algorithm to identify discreditable firms.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research collected registration records of about 113 million Chinese firms and constructed an ownership network with about 6 million nodes.

Key Results

- The probability of a firm to be discreditable is remarkably higher than the average probability given the fact that one of its investors or investees is discreditable.

- An investee has a higher impact on the risk of being a discreditable firm than an investor in average.

- The uncovered correlation of discreditable activities can be considered as a representative example of network effect.

Significance

Identification of discreditable firms is significant for investment attraction, bank lending, equity investment, supplier selection, and job seeking.

Technical Contribution

The study demonstrates the effectiveness of network analysis in identifying discreditable firms.

Novelty

The research highlights the importance of considering network effects in understanding discreditable firm behavior.

Limitations

- The study only used publicly available records of discreditable activities.

- The ownership network may not be exhaustive due to missing data.

Future Work

- Investigating the impact of other types of networks on discreditable firm identification.

- Developing more sophisticated algorithms for identifying discreditable firms using network effects.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIdentification of Key Companies for International Profit Shifting in the Global Ownership Network

Abhijit Chakraborty, Yuichi Ikeda, Tembo Nakamoto

Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network

Frank W. Takes, Eelke M. Heemskerk, Javier Garcia-Bernardo et al.

No citations found for this paper.

Comments (0)