Summary

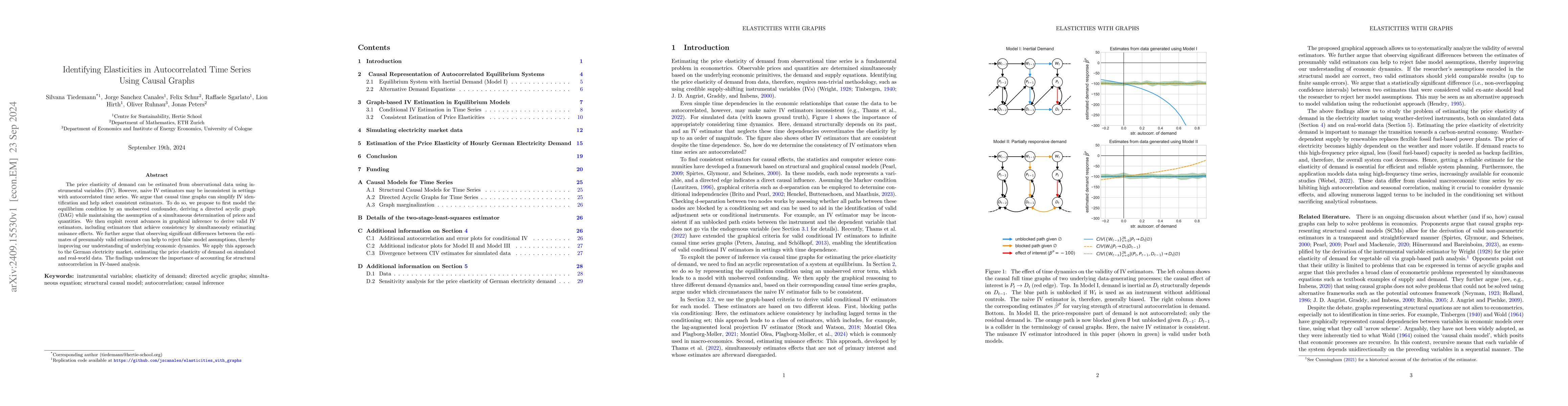

The price elasticity of demand can be estimated from observational data using instrumental variables (IV). However, naive IV estimators may be inconsistent in settings with autocorrelated time series. We argue that causal time graphs can simplify IV identification and help select consistent estimators. To do so, we propose to first model the equilibrium condition by an unobserved confounder, deriving a directed acyclic graph (DAG) while maintaining the assumption of a simultaneous determination of prices and quantities. We then exploit recent advances in graphical inference to derive valid IV estimators, including estimators that achieve consistency by simultaneously estimating nuisance effects. We further argue that observing significant differences between the estimates of presumably valid estimators can help to reject false model assumptions, thereby improving our understanding of underlying economic dynamics. We apply this approach to the German electricity market, estimating the price elasticity of demand on simulated and real-world data. The findings underscore the importance of accounting for structural autocorrelation in IV-based analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCDANs: Temporal Causal Discovery from Autocorrelated and Non-Stationary Time Series Data

Uzma Hasan, Md Osman Gani, Muhammad Hasan Ferdous

Identifying Unique Causal Network from Nonstationary Time Series

Duxin Chen, Mingyu Kang, Wenwu Yu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)