Summary

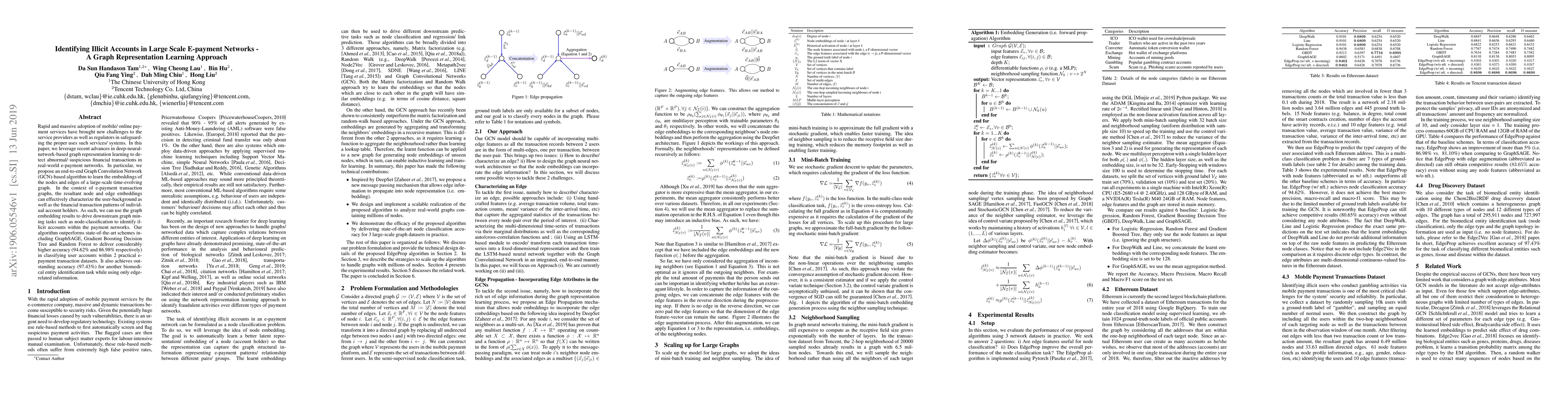

Rapid and massive adoption of mobile/ online payment services has brought new challenges to the service providers as well as regulators in safeguarding the proper uses such services/ systems. In this paper, we leverage recent advances in deep-neural-network-based graph representation learning to detect abnormal/ suspicious financial transactions in real-world e-payment networks. In particular, we propose an end-to-end Graph Convolution Network (GCN)-based algorithm to learn the embeddings of the nodes and edges of a large-scale time-evolving graph. In the context of e-payment transaction graphs, the resultant node and edge embeddings can effectively characterize the user-background as well as the financial transaction patterns of individual account holders. As such, we can use the graph embedding results to drive downstream graph mining tasks such as node-classification to identify illicit accounts within the payment networks. Our algorithm outperforms state-of-the-art schemes including GraphSAGE, Gradient Boosting Decision Tree and Random Forest to deliver considerably higher accuracy (94.62% and 86.98% respectively) in classifying user accounts within 2 practical e-payment transaction datasets. It also achieves outstanding accuracy (97.43%) for another biomedical entity identification task while using only edge-related information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)