Authors

Summary

Identifying reputable Ethereum projects remains a critical challenge within the expanding blockchain ecosystem. The ability to distinguish between legitimate initiatives and potentially fraudulent schemes is non-trivial. This work presents a systematic approach that integrates multiple data sources with advanced analytics to evaluate credibility, transparency, and overall trustworthiness. The methodology applies machine learning techniques to analyse transaction histories on the Ethereum blockchain. The study classifies accounts based on a dataset comprising 2,179 entities linked to illicit activities and 3,977 associated with reputable projects. Using the LightGBM algorithm, the approach achieves an average accuracy of 0.984 and an average AUC of 0.999, validated through 10-fold cross-validation. Key influential factors include time differences between transactions and received_tnx. The proposed methodology provides a robust mechanism for identifying reputable Ethereum projects, fostering a more secure and transparent investment environment. By equipping stakeholders with data-driven insights, this research enables more informed decision-making, risk mitigation, and the promotion of legitimate blockchain initiatives. Furthermore, it lays the foundation for future advancements in trust assessment methodologies, contributing to the continued development and maturity of the Ethereum ecosystem.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research presents a systematic approach using machine learning techniques, specifically the LightGBM algorithm, to analyze transaction histories on the Ethereum blockchain. It classifies Ethereum accounts as either illicit or likely-reputable by integrating multiple data sources, including features like transaction counts and time differences.

Key Results

- The proposed methodology achieved an average accuracy of 0.984 and an average AUC of 0.999, validated through 10-fold cross-validation.

- Key influential factors for classification include time differences between transactions and received_atnx.

- The model effectively distinguished between illicit accounts (2,179) and likely-reputable projects (3,978) from CoinGecko.

Significance

This research is crucial for enhancing investor confidence by providing a data-driven mechanism to assess the reputability of Ethereum projects, thus fostering a more secure and transparent investment environment.

Technical Contribution

The research introduces an advanced LightGBM classification model for identifying reputable Ethereum projects, demonstrating exceptional effectiveness with an average AUC of 0.999.

Novelty

This work differs from existing research by focusing on evaluating project credibility at an individual account level, providing a more precise and comprehensive assessment of reputability in the Ethereum ecosystem.

Limitations

- The study's dataset is limited to transactions until June 2019, which might not capture recent developments in the Ethereum ecosystem.

- Some features, like total Ether sent and received, were derived from BigQuery, potentially introducing latency or data inconsistency issues.

Future Work

- Explore the applicability of the proposed approach across different blockchain networks.

- Refine the methodology to assess reputability at a more granular transactional level.

Paper Details

PDF Preview

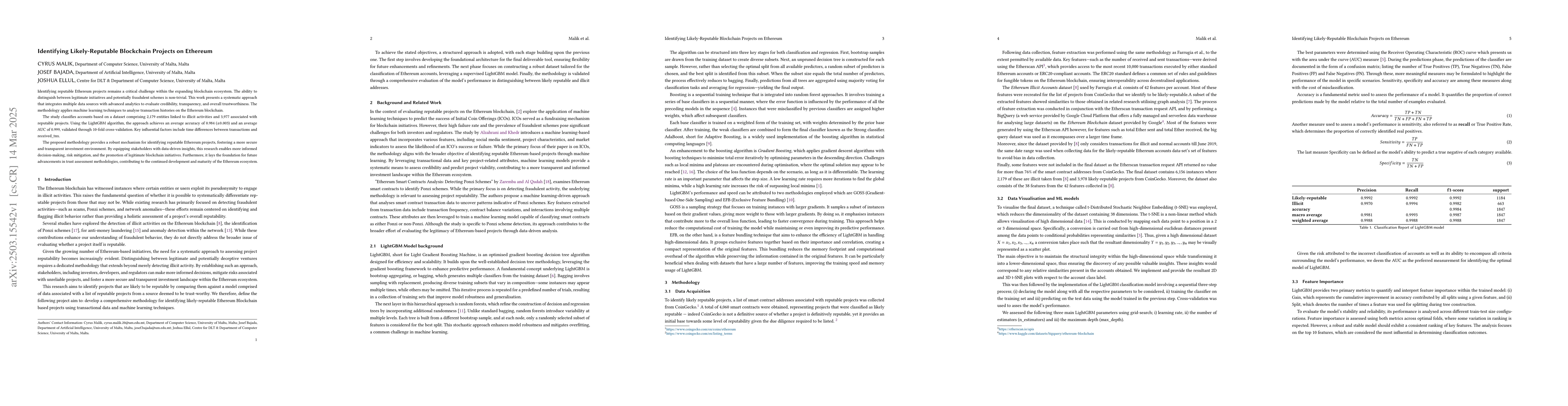

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChaos Engineering of Ethereum Blockchain Clients

Long Zhang, Benoit Baudry, Martin Monperrus et al.

Self-Replicating and Self-Employed Smart Contract on Ethereum Blockchain

Norihiro Maruyama, Takashi Ikegami, Atsushi Masumori

| Title | Authors | Year | Actions |

|---|

Comments (0)