Summary

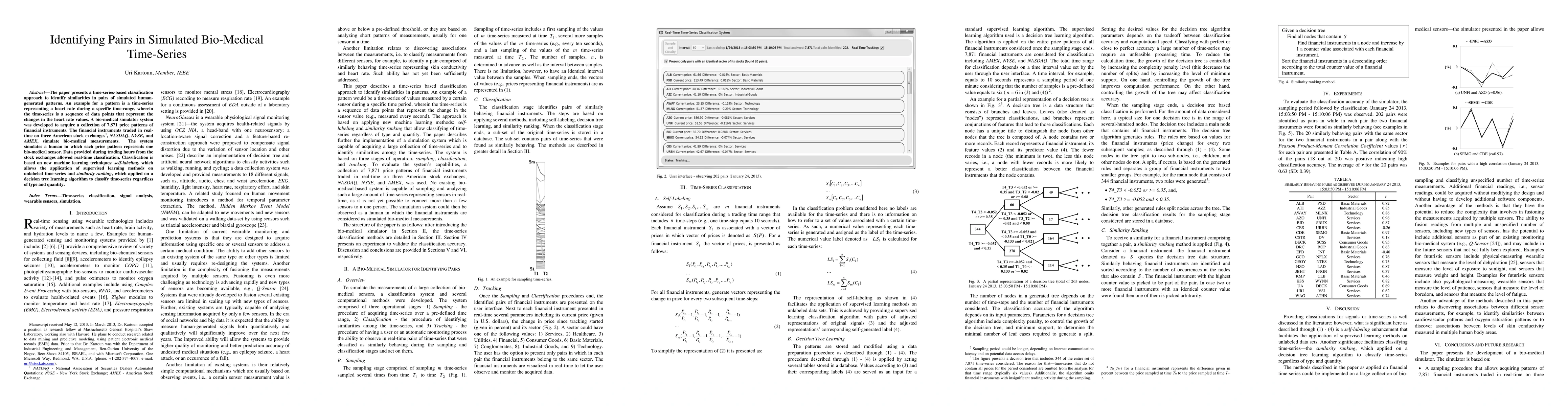

The paper presents a time-series-based classification approach to identify similarities in pairs of simulated human-generated patterns. An example for a pattern is a time-series representing a heart rate during a specific time-range, wherein the time-series is a sequence of data points that represent the changes in the heart rate values. A bio-medical simulator system was developed to acquire a collection of 7,871 price patterns of financial instruments. The financial instruments traded in real-time on three American stock exchanges, NASDAQ, NYSE, and AMEX, simulate bio-medical measurements. The system simulates a human in which each price pattern represents one bio-medical sensor. Data provided during trading hours from the stock exchanges allowed real-time classification. Classification is based on new machine learning techniques: self-labeling, which allows the application of supervised learning methods on unlabeled time-series and similarity ranking, which applied on a decision tree learning algorithm to classify time-series regardless of type and quantity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKorean Bio-Medical Corpus (KBMC) for Medical Named Entity Recognition

Minseok Kim, Jean Seo, Sungjoo Byun et al.

BiMediX2: Bio-Medical EXpert LMM for Diverse Medical Modalities

Timothy Baldwin, Salman Khan, Hisham Cholakkal et al.

No citations found for this paper.

Comments (0)