Summary

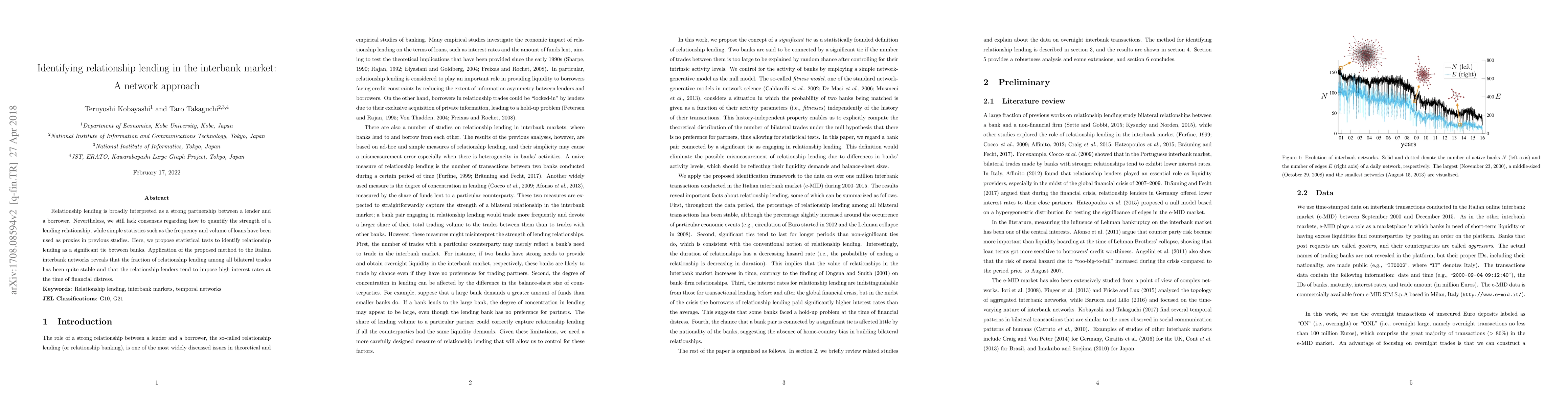

Relationship lending is broadly interpreted as a strong partnership between a lender and a borrower. Nevertheless, we still lack consensus regarding how to quantify the strength of a lending relationship, while simple statistics such as the frequency and volume of loans have been used as proxies in previous studies. Here, we propose statistical tests to identify relationship lending as a significant tie between banks. Application of the proposed method to the Italian interbank networks reveals that the fraction of relationship lending among all bilateral trades has been quite stable and that the relationship lenders tend to impose high interest rates at the time of financial distress.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)