Authors

Summary

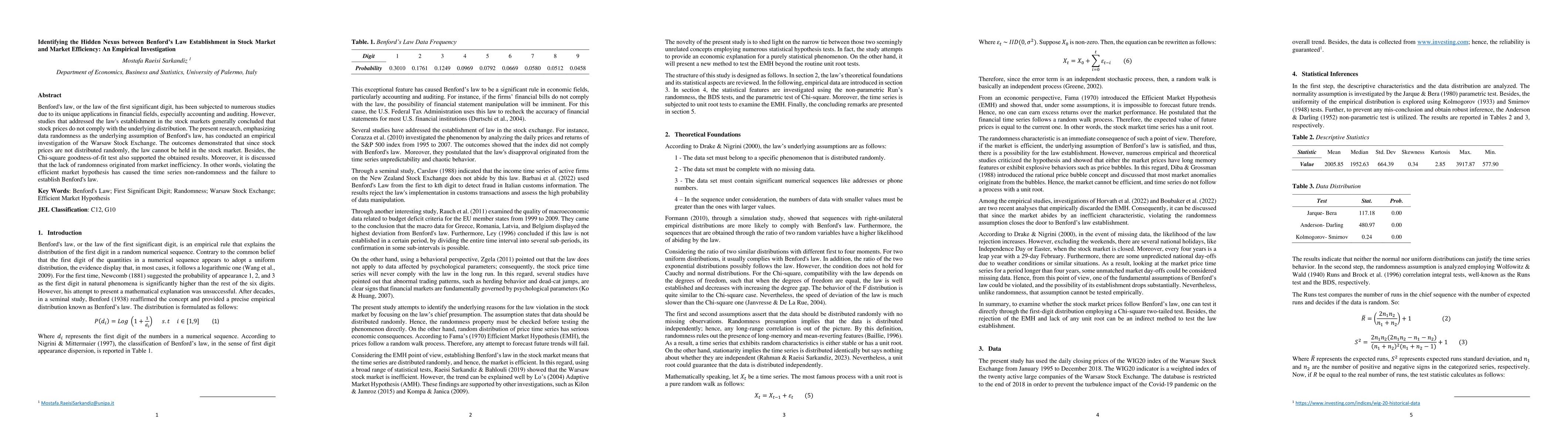

Benford's law, or the law of the first significant digit, has been subjected to numerous studies due to its unique applications in financial fields, especially accounting and auditing. However, studies that addressed the law's establishment in the stock markets generally concluded that stock prices do not comply with the underlying distribution. The present research, emphasizing data randomness as the underlying assumption of Benford's law, has conducted an empirical investigation of the Warsaw Stock Exchange. The outcomes demonstrated that since stock prices are not distributed randomly, the law cannot be held in the stock market. Besides, the Chi-square goodness-of-fit test also supported the obtained results. Moreover, it is discussed that the lack of randomness originated from market inefficiency. In other words, violating the efficient market hypothesis has caused the time series non-randomness and the failure to establish Benford's law.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)