Summary

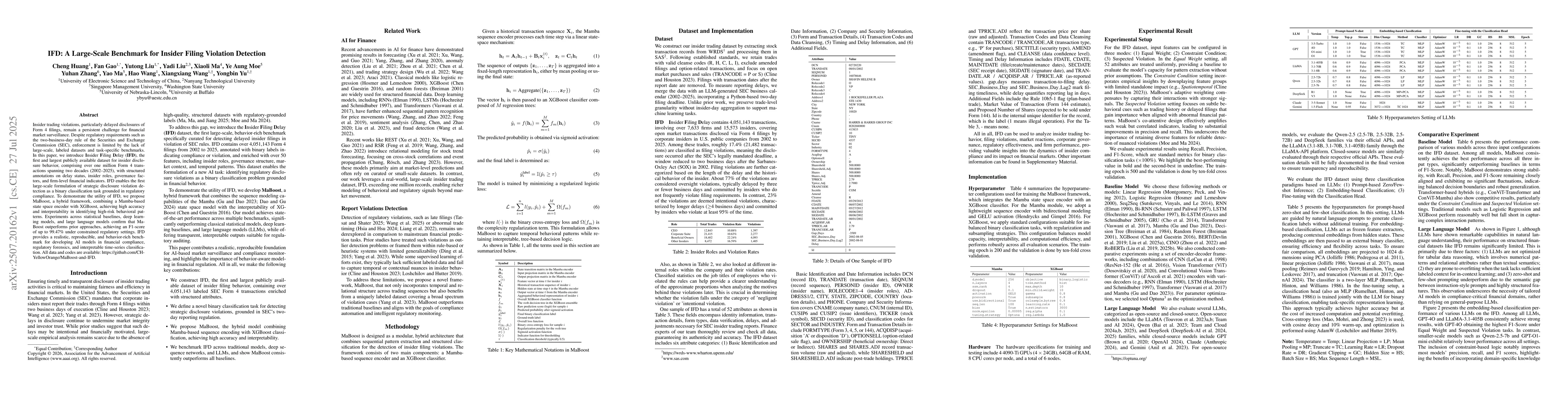

Insider trading violations, particularly delayed disclosures of Form 4 filings, remain a persistent challenge for financial market surveillance. Despite regulatory requirements such as the two-business-day rule of the Securities and Exchange Commission (SEC), enforcement is limited by the lack of large-scale, labeled datasets and task-specific benchmarks. In this paper, we introduce Insider Filing Delay (IFD), the first and largest publicly available dataset for insider disclosure behavior, comprising over one million Form 4 transactions spanning two decades (2002-2025), with structured annotations on delay status, insider roles, governance factors, and firm-level financial indicators. IFD enables the first large-scale formulation of strategic disclosure violation detection as a binary classification task grounded in regulatory compliance. To demonstrate the utility of IFD, we propose MaBoost, a hybrid framework combining a Mamba-based state space encoder with XGBoost, achieving high accuracy and interpretability in identifying high-risk behavioral patterns. Experiments across statistical baselines, deep learning models, and large language models confirm that MaBoost outperforms prior approaches, achieving an F1-score of up to 99.47% under constrained regulatory settings. IFD provides a realistic, reproducible, and behavior-rich benchmark for developing AI models in financial compliance, regulatory forensics, and interpretable time-series classification. All data and codes are available: https://github.com/CH-YellowOrange/MaBoost-and-IFD.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Large-scale Universal Evaluation Benchmark For Face Forgery Detection

Jie Song, Lechao Cheng, Mingli Song et al.

Continual-MEGA: A Large-scale Benchmark for Generalizable Continual Anomaly Detection

Geonhui Jang, YoungJoon Yoo, Sungmin Cha et al.

No citations found for this paper.

Comments (0)