Summary

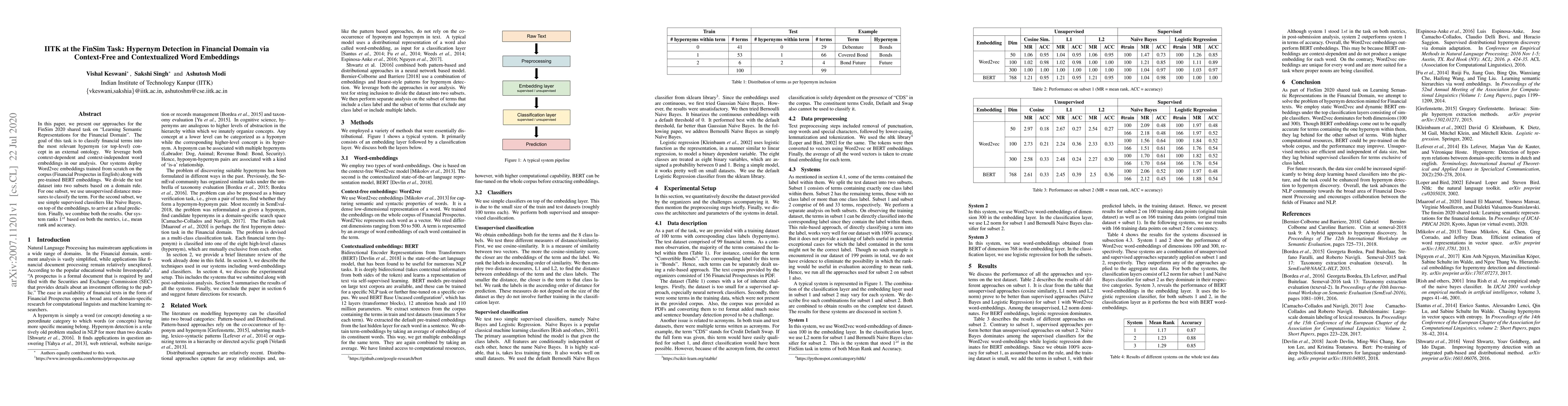

In this paper, we present our approaches for the FinSim 2020 shared task on "Learning Semantic Representations for the Financial Domain". The goal of this task is to classify financial terms into the most relevant hypernym (or top-level) concept in an external ontology. We leverage both context-dependent and context-independent word embeddings in our analysis. Our systems deploy Word2vec embeddings trained from scratch on the corpus (Financial Prospectus in English) along with pre-trained BERT embeddings. We divide the test dataset into two subsets based on a domain rule. For one subset, we use unsupervised distance measures to classify the term. For the second subset, we use simple supervised classifiers like Naive Bayes, on top of the embeddings, to arrive at a final prediction. Finally, we combine both the results. Our system ranks 1st based on both the metrics, i.e., mean rank and accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDICoE@FinSim-3: Financial Hypernym Detection using Augmented Terms and Distance-based Features

Lefteris Loukas, Konstantinos Bougiatiotis, Manos Fergadiotis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)