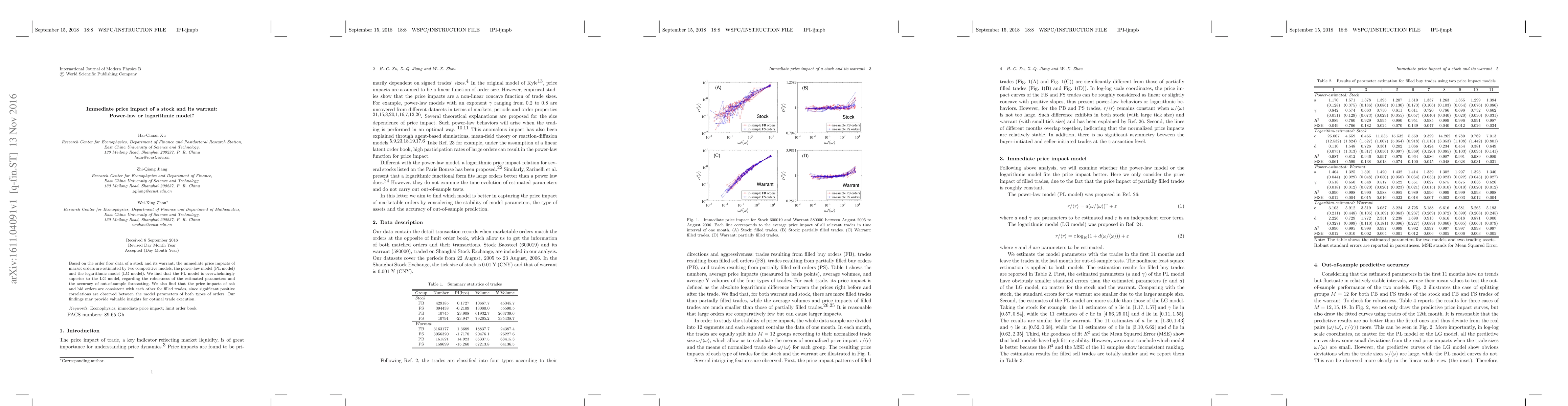

Summary

Based on the order flow data of a stock and its warrant, the immediate price impacts of market orders are estimated by two competitive models, the power-law model (PL model) and the logarithmic model (LG model). We find that the PL model is overwhelmingly superior to the LG model, regarding the robustness of the estimated parameters and the accuracy of out-of-sample forecasting. We also find that the price impacts of ask and bid orders are consistent with each other for filled trades, since significant positive correlations are observed between the model parameters of both types of orders. Our findings may provide valuable insights for optimal trade execution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)