Summary

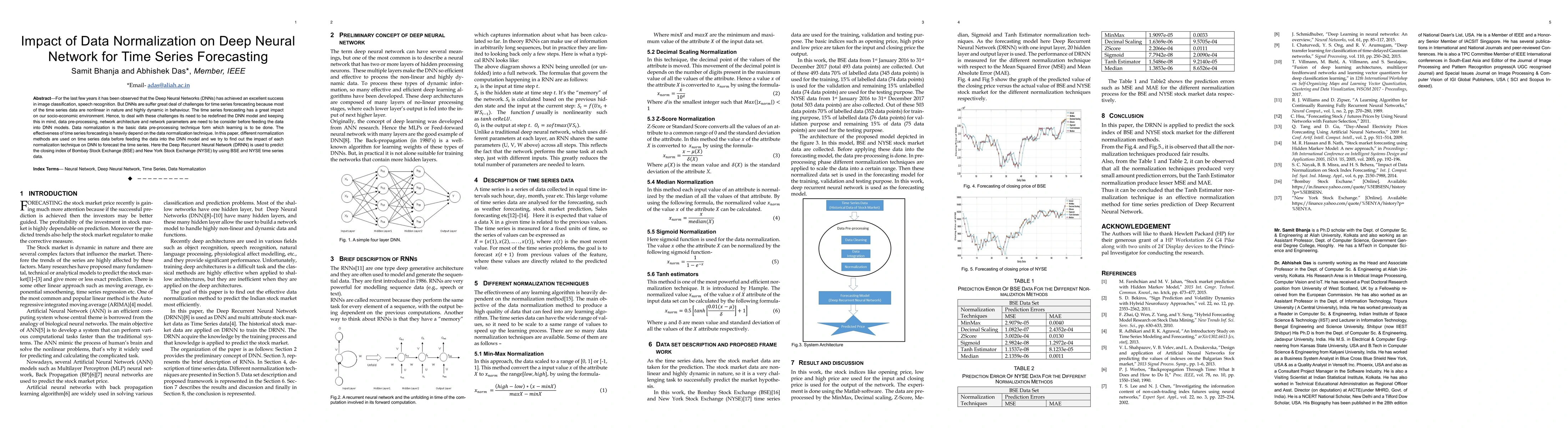

For the last few years it has been observed that the Deep Neural Networks (DNNs) has achieved an excellent success in image classification, speech recognition. But DNNs are suffer great deal of challenges for time series forecasting because most of the time series data are nonlinear in nature and highly dynamic in behaviour. The time series forecasting has a great impact on our socio-economic environment. Hence, to deal with these challenges its need to be redefined the DNN model and keeping this in mind, data pre-processing, network architecture and network parameters are need to be consider before feeding the data into DNN models. Data normalization is the basic data pre-processing technique form which learning is to be done. The effectiveness of time series forecasting is heavily depend on the data normalization technique. In this paper, different normalization methods are used on time series data before feeding the data into the DNN model and we try to find out the impact of each normalization technique on DNN to forecast the time series. Here the Deep Recurrent Neural Network (DRNN) is used to predict the closing index of Bombay Stock Exchange (BSE) and New York Stock Exchange (NYSE) by using BSE and NYSE time series data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtended Deep Adaptive Input Normalization for Preprocessing Time Series Data for Neural Networks

Francesco Sanna Passino, Marcus A. K. September, Leonie Goldmann et al.

GAS-Norm: Score-Driven Adaptive Normalization for Non-Stationary Time Series Forecasting in Deep Learning

Edoardo Urettini, Daniele Atzeni, Reshawn J. Ramjattan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)