Summary

In this paper, we present a multi-period trading model by assuming that traders face not only asymmetric information but also heterogenous prior beliefs, under the requirement that the insider publicly disclose his stock trades after the fact. We show that there is an equilibrium in which the irrational insider camouflages his trades with a noise component so that his private information is revealed slowly and linearly whenever he is overconfident or underconfident. We also investigate the relationship between the heterogeneous beliefs and the trade intensity in the presence of trade disclosure, and show that the weights on asymmetric information and heterogeneous prior beliefs are opposite in sign and they change alternatively in the next period. Under the requirement of disclosure, the irrational insider trades more aggressively and leads to smaller market depth. Moreover, the co-existence of "public disclosure requirement" and "heterogeneous prior beliefs" leads to the fluctuant multi-period expected profits and a larger total expected trading volume which is positively related to the degree of heterogeneity. More importantly, even public disclosure may lead to negative profits of the irrational insider's in some periods, inside trading remains profitable from the whole trading period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

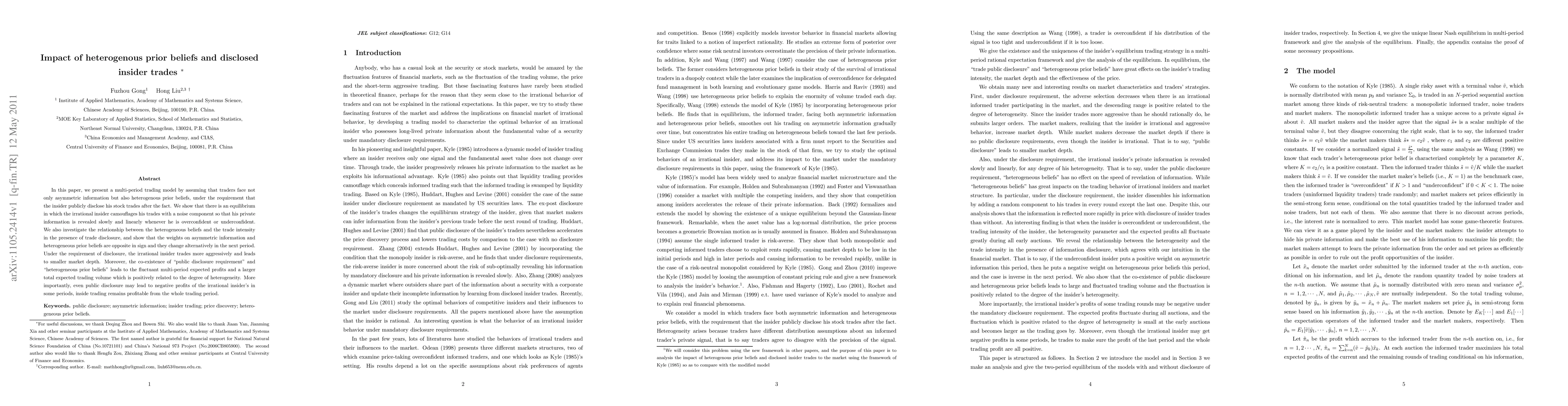

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring price impact and information content of trades in a time-varying setting

F. Campigli, G. Bormetti, F. Lillo

No citations found for this paper.

Comments (0)