Authors

Summary

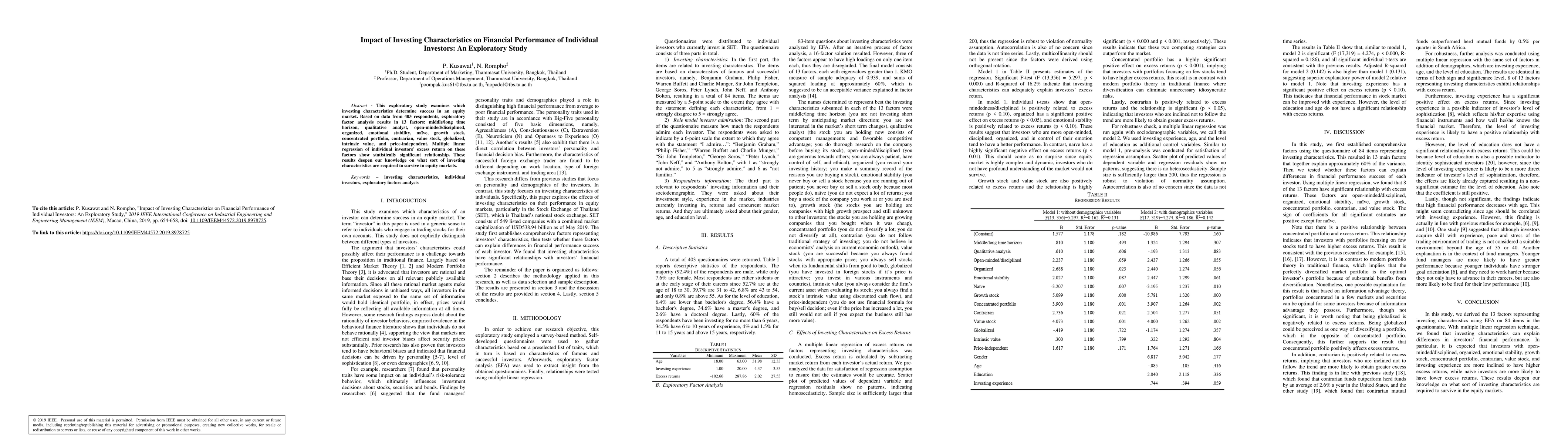

This exploratory study examines which investing characteristics determine success in an equity market. Based on data from 403 respondents, exploratory factor analysis results in 13 factors: middle/long time horizon, qualitative analyst, open-minded/disciplined, organized, emotional stability, na\"ive, growth stock, concentrated portfolio, contrarian, value stock, globalized, intrinsic value, and price-independent. Multiple linear regression of individual investors' excess return on these factors show statistically significant relationship. These results deepen our knowledge on what sort of investing characteristics are required to survive in equity markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)