Authors

Summary

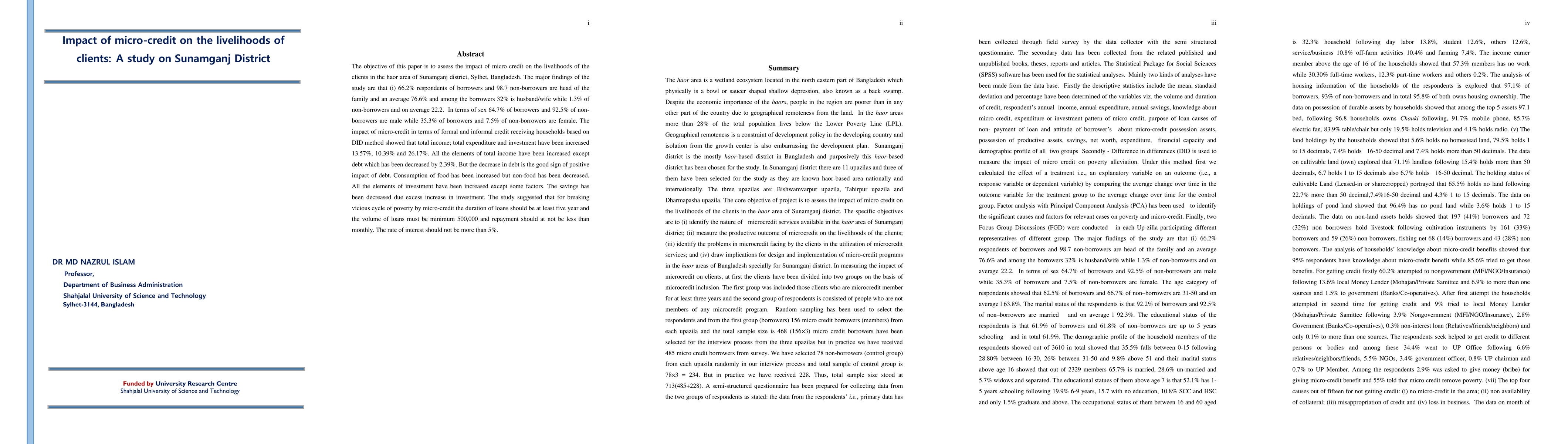

The objective of this paper is to assess the impact of micro credit on the livelihoods of the clients in the haor area of Sunamganj district, Sylhet, Bangladesh. The major findings of the study are that 66.2 percent respondents of borrowers and 98.7 non-borrowers are head of the family and an average 76.6 percent and among the borrowers 32 percent is husband/wife while 1.3 percent of non-borrowers and on average 22.2. In terms of sex 64.7 percent of borrowers and 92.5 percent of non-borrowers are male while 35.3 percent of borrowers and 7.5 percent of non-borrowers are female. The impact of micro-credit in terms of formal and informal credit receiving households based on DID method showed that total income, total expenditure and investment have been increased 13.57 percent, 10.39 percent and 26.17 percent. All the elements of total income have been increased except debt which has been decreased by 2.39 percent. But the decrease in debt is the good sign of positive impact of debt. Consumption of food has been increased but non-food has been decreased. All the elements of investment have been increased except some factors. The savings has been decreased due excess increase in investment. The study suggested that for breaking vicious cycle of poverty by micro-credit the duration of loans should be at least five year and the volume of loans must be minimum 500,000 and repayment should at not be less than monthly. The rate of interest should not be more than 5 percent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Causal Impact of Credit Lines on Spending Distributions

Zhixiang Huang, Qi Wu, Chaoqun Wang et al.

The Impact of Implicit Government Guarantee on Credit Rating of Municipal Investment Bonds

Yan Zhang, Lin Chen, Yixiang Tian

No citations found for this paper.

Comments (0)