Authors

Summary

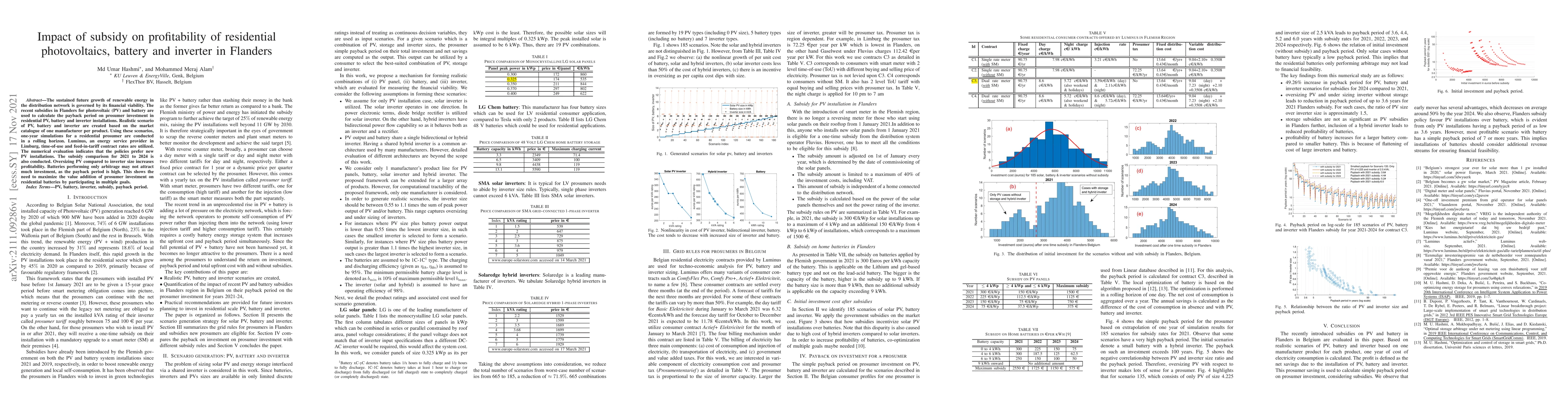

The sustained future growth of renewable energy in the distribution network is governed by its financial viability. The recent subsidies in Flanders for photovoltaic (PV) and battery are used to calculate the payback period on prosumer investment in residential PV, battery and inverter installations. Realistic scenario of PV, battery and inverter are created based on the market catalogue of one manufacturer per product. Using these scenarios, one-year simulations for a residential prosumer are conducted in a rolling horizon. Luminus, an energy service provider in Limburg, time-of-use and feed-in-tariff contract rates are utilized. The numerical evaluation indicates that the policies prefer new PV installations. The subsidy comparison for 2021 to 2024 is also conducted. Oversizing PV compared to inverter size increases profitability. Batteries performing only arbitrage may not attract much investment, as the payback period is high. This shows the need to maximize the value addition of prosumer investment on residential batteries by participating in multiple goals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDesign of Battery management system for Residential applications

Poushali Pal, Devabalaji K. R, S. Priyadarshini

No citations found for this paper.

Comments (0)