Summary

In this note we describe the application of existing smart contract technologies with the aim to construct a new digital representation of a financial derivative contract. We compare several existing DLT based technologies. We provide a detailed description of two separate prototypes which are able to be executed on a centralized and on a DLT platform respectively. Beyond that we highlight some insights on legal aspects as well as on common integration challenges regarding existing process and system landscapes. For a further introductory note and motivation on the theoretical concept we refer to https://www.law.ox.ac.uk/business-law-blog/blog/2018/12/smart-derivative-contract-constructing-digital-financial-derivative . A very detailed methodological overview of the concept of a smart derivative contract can be found in doi:10.2139/ssrn.3163074.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

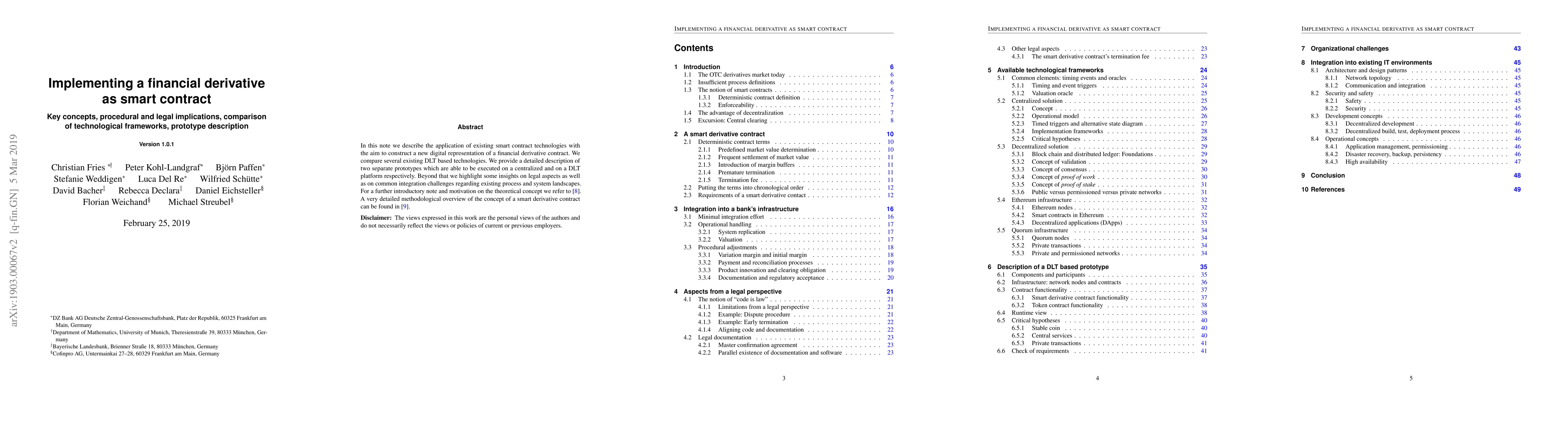

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)