Summary

Pricing exotic multi-asset path-dependent options requires extensive Monte Carlo simulations. In the recent years the interest to the Quasi-monte Carlo technique has been renewed and several results have been proposed in order to improve its efficiency with the notion of effective dimension. To this aim, Imai and Tan introduced a general variance reduction technique in order to minimize the nominal dimension of the Monte Carlo method. Taking into account these advantages, we investigate this approach in detail in order to make it faster from the computational point of view. Indeed, we realize the linear transformation decomposition relying on a fast ad hoc QR decomposition that considerably reduces the computational burden. This setting makes the linear transformation method even more convenient from the computational point of view. We implement a high-dimensional (2500) Quasi-Monte Carlo simulation combined with the linear transformation in order to price Asian basket options with same set of parameters published by Imai and Tan. For the simulation of the high-dimensional random sample, we use a 50-dimensional scrambled Sobol sequence for the first 50 components, determined by the linear transformation method, and pad the remaining ones out by the Latin Hypercube Sampling. The aim of this numerical setting is to investigate the accuracy of the estimation by giving a higher convergence rate only to those components selected by the linear transformation technique. We launch our simulation experiment also using the standard Cholesky and the principal component decomposition methods with pseudo-random and Latin Hypercube sampling generators. Finally, we compare our results and computational times, with those presented in Imai and Tan.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

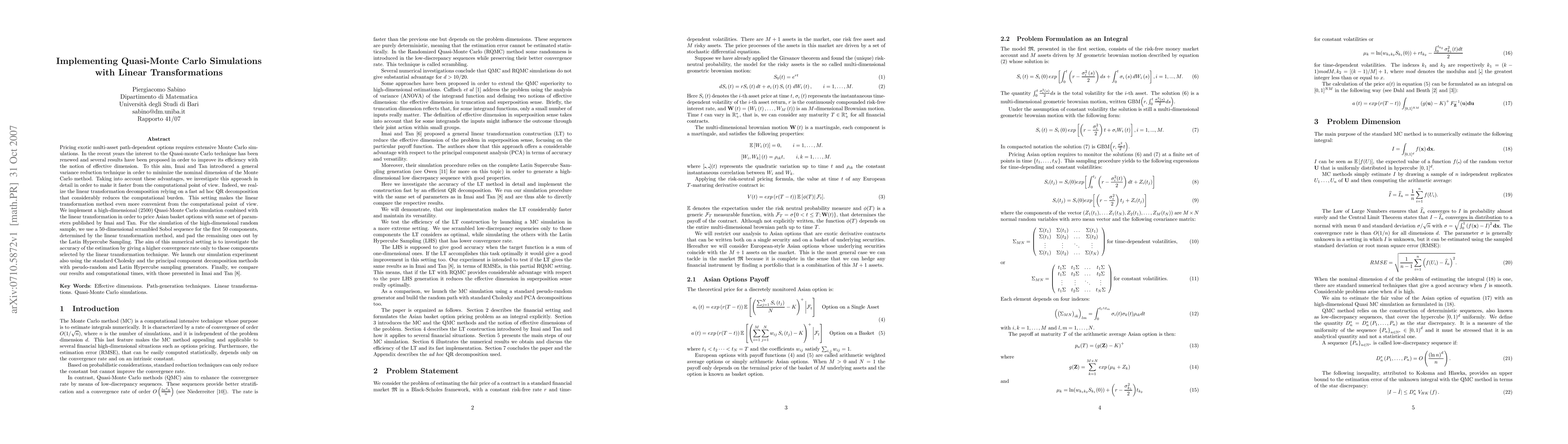

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Quasi-Monte Carlo Method with Krylov Linear Solvers for Multigroup Neutron Transport Simulations

C. T. Kelley, Ryan McClarren, Ilham Variansyah et al.

iQMC: Iterative Quasi-Monte Carlo for k-Eigenvalue Neutron Transport Simulations

C. T. Kelley, Ryan G. McClarren, Ilham Variansyah et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)