Summary

Option written on several foreign exchange rates (FXRs) depends on correlation between the rates. To evaluate the option, historical estimates for correlations can be used but usually they are not stable. More significantly, pricing of the option using these estimates is usually inconsistent to the traded vanilla contracts. To price options written on several FXRs with the same denominating currency, financial practitioners and traders often use implied correlations calculated from implied volatilities of FXRs that form "currency triangles". However, some options may have underlying FXRs with different denominating currencies. In this paper, we present the formula for the implied correlations between such FXRs. These can be used for valuation, for example, barrier option on two FXRs with different denominating currencies where one FXR determines how much the option is in or out of the money at maturity while another FXR is related to the barrier. Other relevant options are straightforward.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research uses implied volatilities of FXRs to estimate correlations between FXRs with different denominating currencies.

Key Results

- Implied correlation between FXRs with the same denominating currency can be found using implied volatilities of these FXRs and the implied volatility of cross FXRs.

- Equation (10) allows to find implied correlation between jiX/ and kmX/ using implied volatilities ji/ˆσ and km/ˆσ of these FXRs and implied volatilities of cross FXRs ki/ˆσ, jm/ˆσ, kj/ˆσ and mi/ˆσ.

- The value of a barrier option depends on the time-structure of volatilities and correlations.

- Equations (6) and (10) can be used to find implied correlations and volatilities over future time periods.

Significance

This research provides a method for pricing multi-currency options with different denominating currencies, which is important for large international corporations and sophisticated speculators.

Technical Contribution

The research provides new formulas for implied correlations between FXRs with different denominating currencies, which can be used to price multi-currency options.

Novelty

This work is novel because it addresses the pricing of multi-currency options with different denominating currencies and provides a method using implied volatilities.

Limitations

- The model assumes constant parameters, which may not be realistic in practice.

- The pricing of barrier options requires numerical procedures, which can be complicated.

Future Work

- Developing a multivariate extension of the state-dependent volatility model to include time and state dependent functions for volatilities and correlations.

- Improving the method by considering more complicated models that account for strike dependence in implied volatilities.

Paper Details

PDF Preview

Key Terms

Citation Network

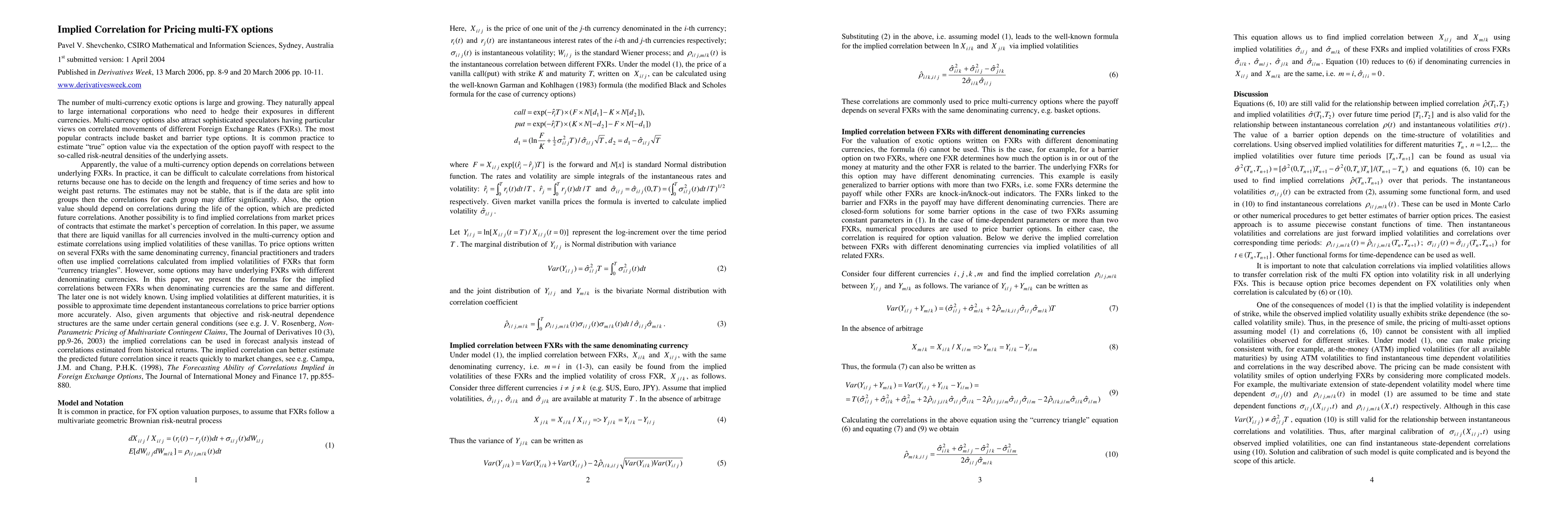

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlternative models for FX: pricing double barrier options in regime-switching L\'evy models with memory

Svetlana Boyarchenko, Sergei Levendorskiĭ

| Title | Authors | Year | Actions |

|---|

Comments (0)