Authors

Summary

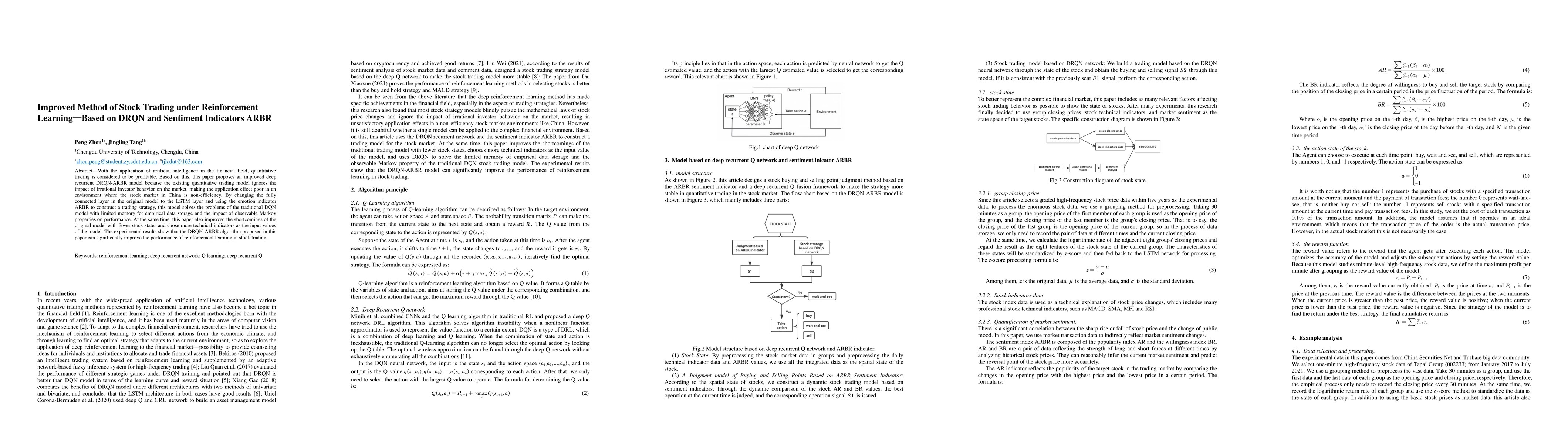

With the application of artificial intelligence in the financial field, quantitative trading is considered to be profitable. Based on this, this paper proposes an improved deep recurrent DRQN-ARBR model because the existing quantitative trading model ignores the impact of irrational investor behavior on the market, making the application effect poor in an environment where the stock market in China is non-efficiency. By changing the fully connected layer in the original model to the LSTM layer and using the emotion indicator ARBR to construct a trading strategy, this model solves the problems of the traditional DQN model with limited memory for empirical data storage and the impact of observable Markov properties on performance. At the same time, this paper also improved the shortcomings of the original model with fewer stock states and chose more technical indicators as the input values of the model. The experimental results show that the DRQN-ARBR algorithm proposed in this paper can significantly improve the performance of reinforcement learning in stock trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning the Market: Sentiment-Based Ensemble Trading Agents

Yi Wang, Ryan Chen, Vipin Chaudhary et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)