Authors

Summary

Many management decisions involve accumulated random realizations for which the expected value and variance are assumed to be known. We revisit the tail behavior of such quantities when individual realizations are independent, and we develop new sharper bounds on the tail probability and expected linear loss. The underlying distribution is semi-parametric in the sense that it remains unrestricted other than the assumed mean and variance. Our bounds complement well-established results in the literature, including those based on aggregation, which often fail to take full account of independence and use less elegant proofs. New insights include a proof that in the non-identical case, the distributions attaining the bounds have the equal range property, and that the impact of each random variable on the expected value of the sum can be isolated using an extension of the Korkine identity. We show that the new bounds %not only complement the extant results but also open up abundant practical applications, including improved pricing of product bundles, more precise option pricing, more efficient insurance design, and better inventory management. For example, we establish a new solution to the optimal bundling problem, yielding a 17\% uplift in per-bundle profits, and a new solution to the inventory problem, yielding a 5.6\% cost reduction for a model with 20 retailers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

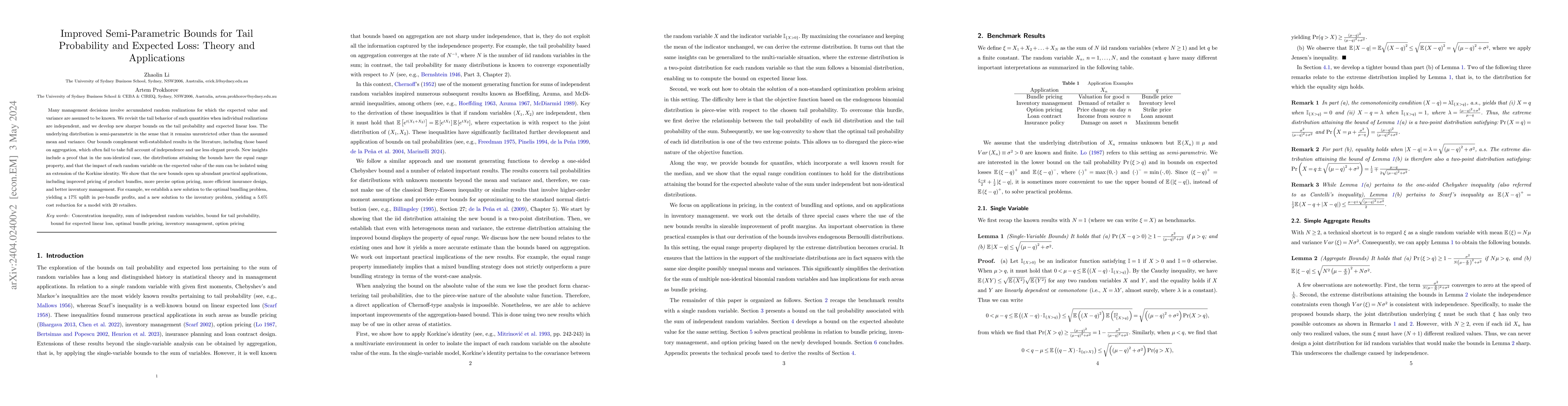

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemi-parametric bulk and tail regression using spline-based neural networks

Reetam Majumder, Jordan Richards

No citations found for this paper.

Comments (0)