Summary

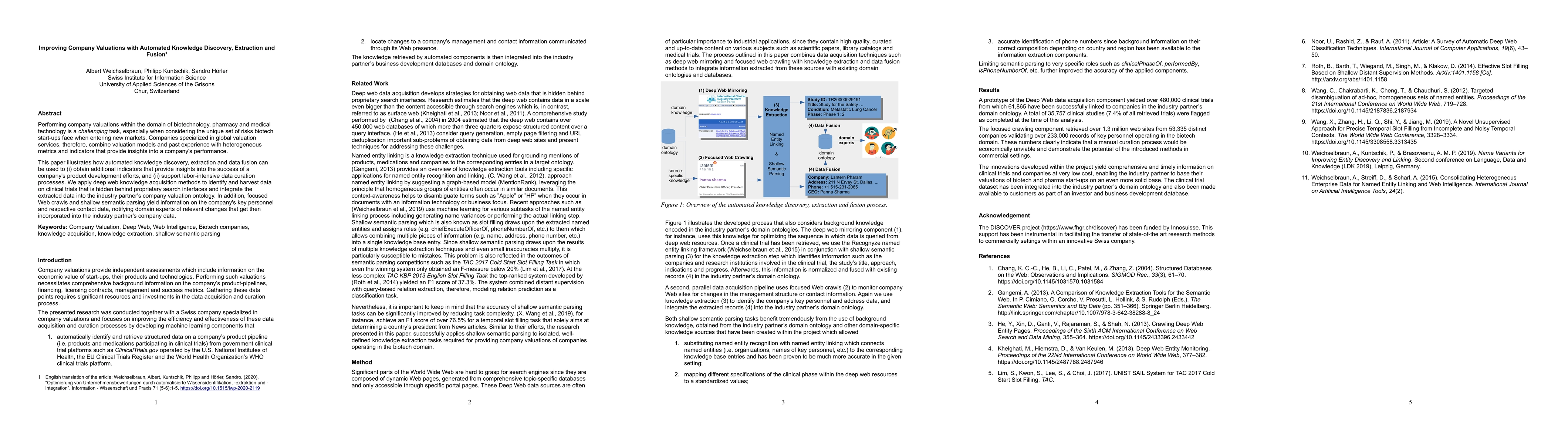

Performing company valuations within the domain of biotechnology, pharmacy and medical technology is a challenging task, especially when considering the unique set of risks biotech start-ups face when entering new markets. Companies specialized in global valuation services, therefore, combine valuation models and past experience with heterogeneous metrics and indicators that provide insights into a company's performance. This paper illustrates how automated knowledge discovery, extraction and data fusion can be used to (i) obtain additional indicators that provide insights into the success of a company's product development efforts, and (ii) support labor-intensive data curation processes. We apply deep web knowledge acquisition methods to identify and harvest data on clinical trials that is hidden behind proprietary search interfaces and integrate the extracted data into the industry partner's company valuation ontology. In addition, focused Web crawls and shallow semantic parsing yield information on the company's key personnel and respective contact data, notifying domain experts of relevant changes that get then incorporated into the industry partner's company data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKnowledge-aware equation discovery with automated background knowledge extraction

Alexander Hvatov, Elizaveta Ivanchik

Improving Low-Resource Sequence Labeling with Knowledge Fusion and Contextual Label Explanations

Bin Cui, Feiyang Ye, Yilei Wang et al.

Multi scale Feature Extraction and Fusion for Online Knowledge Distillation

Yinglei Teng, Panpan Zou, Tao Niu

| Title | Authors | Year | Actions |

|---|

Comments (0)