Summary

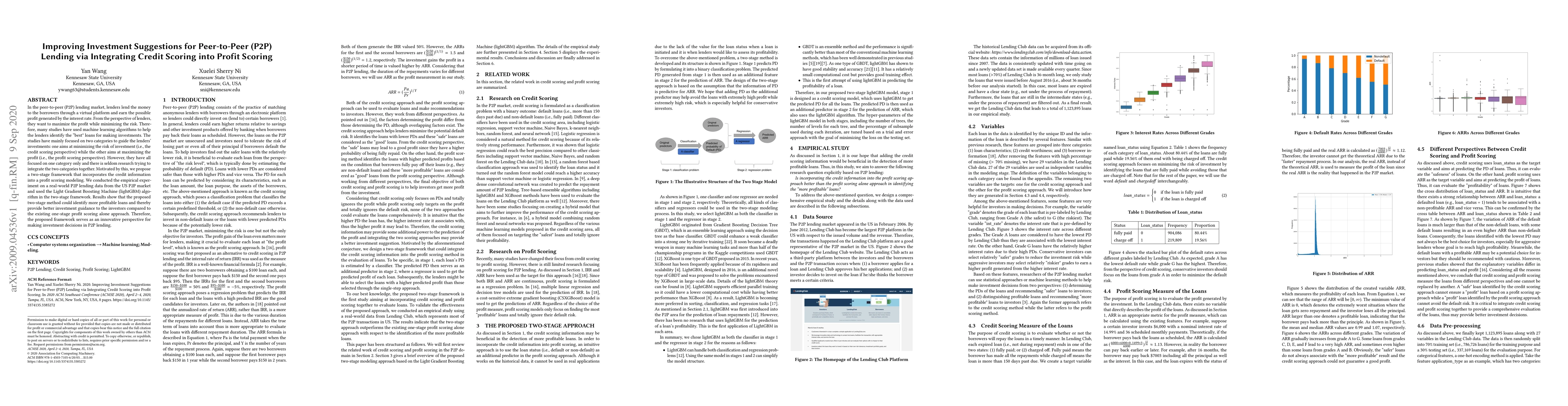

In the peer-to-peer (P2P) lending market, lenders lend the money to the borrowers through a virtual platform and earn the possible profit generated by the interest rate. From the perspective of lenders, they want to maximize the profit while minimizing the risk. Therefore, many studies have used machine learning algorithms to help the lenders identify the "best" loans for making investments. The studies have mainly focused on two categories to guide the lenders' investments: one aims at minimizing the risk of investment (i.e., the credit scoring perspective) while the other aims at maximizing the profit (i.e., the profit scoring perspective). However, they have all focused on one category only and there is seldom research trying to integrate the two categories together. Motivated by this, we propose a two-stage framework that incorporates the credit information into a profit scoring modeling. We conducted the empirical experiment on a real-world P2P lending data from the US P2P market and used the Light Gradient Boosting Machine (lightGBM) algorithm in the two-stage framework. Results show that the proposed two-stage method could identify more profitable loans and thereby provide better investment guidance to the investors compared to the existing one-stage profit scoring alone approach. Therefore, the proposed framework serves as an innovative perspective for making investment decisions in P2P lending.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFairness in Credit Scoring: Assessment, Implementation and Profit Implications

Nikita Kozodoi, Stefan Lessmann, Johannes Jacob

| Title | Authors | Year | Actions |

|---|

Comments (0)