Summary

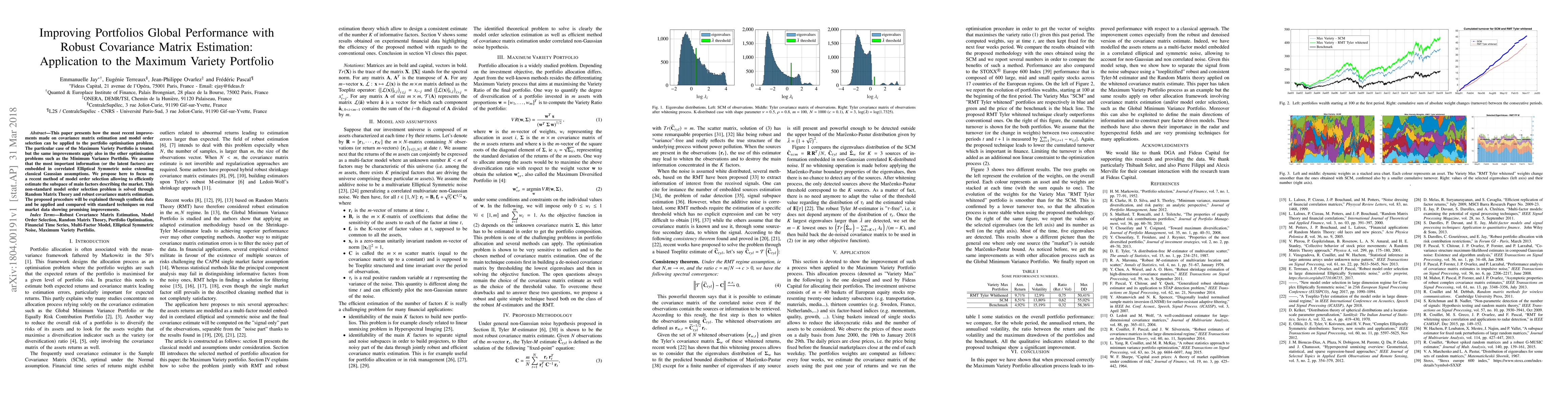

This paper presents how the most recent improvements made on covariance matrix estimation and model order selection can be applied to the portfolio optimisation problem. The particular case of the Maximum Variety Portfolio is treated but the same improvements apply also in the other optimisation problems such as the Minimum Variance Portfolio. We assume that the most important information (or the latent factors) are embedded in correlated Elliptical Symmetric noise extending classical Gaussian assumptions. We propose here to focus on a recent method of model order selection allowing to efficiently estimate the subspace of main factors describing the market. This non-standard model order selection problem is solved through Random Matrix Theory and robust covariance matrix estimation. The proposed procedure will be explained through synthetic data and be applied and compared with standard techniques on real market data showing promising improvements.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)