Summary

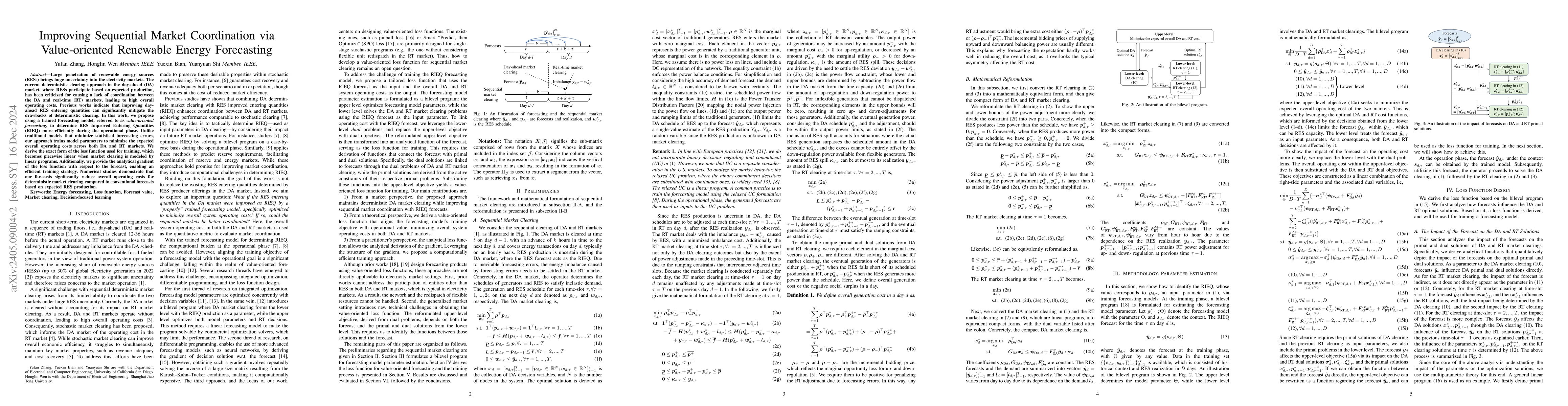

Large penetration of renewable energy sources (RESs) brings huge uncertainty into the electricity markets. While existing deterministic market clearing fails to accommodate the uncertainty, the recently proposed stochastic market clearing struggles to achieve desirable market properties. In this work, we propose a value-oriented forecasting approach, which tactically determines the RESs generation that enters the day-ahead market. With such a forecast, the existing deterministic market clearing framework can be maintained, and the day-ahead and real-time overall operation cost is reduced. At the training phase, the forecast model parameters are estimated to minimize expected day-ahead and real-time overall operation costs, instead of minimizing forecast errors in a statistical sense. Theoretically, we derive the exact form of the loss function for training the forecast model that aligns with such a goal. For market clearing modeled by linear programs, this loss function is a piecewise linear function. Additionally, we derive the analytical gradient of the loss function with respect to the forecast, which inspires an efficient training strategy. A numerical study shows our forecasts can bring significant benefits of the overall cost reduction to deterministic market clearing, compared to quality-oriented forecasting approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersToward Value-oriented Renewable Energy Forecasting: An Iterative Learning Approach

Mengshuo Jia, Yuanyuan Shi, Yufan Zhang et al.

Deriving Loss Function for Value-oriented Renewable Energy Forecasting

Yuanyuan Shi, Yufan Zhang, Yuexin Bian et al.

Budget-constrained Collaborative Renewable Energy Forecasting Market

Ricardo J. Bessa, Carla Goncalves, Tiago Teixeira et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)